If these tariff levels persist, the US economy faces a heightened risk of recession, alongside inflationary pressures, placing the Federal Reserve in a precarious position. Estimates suggest that a 25% tariff increase could reduce US growth by up to 2.5% and increase inflation by up to 1.5% over the next two to three years.

Given these risks, investors might be encouraged to shift away from US markets. Meanwhile, gold has surged on the announcement and shows further scope for rallying, while bonds have become more attractive due to growth risks and their diversification benefits. Investors should prepare for potential economic challenges and consider long-term investment strategies.”

– Narendra Babu, Senior Director, Financial Marketing Services

Market Pulse

![]()

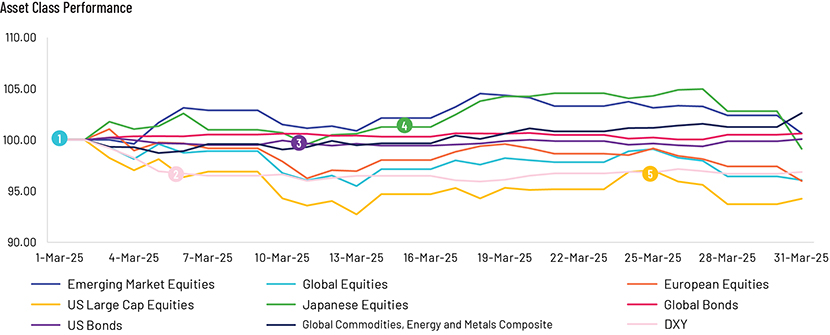

1. March 1: The Global Equities market reacted to the anticipation of new U.S. trade tariffs, leading to increase volatility.

2. March 6: The DXY remained near multi-month lows, struggling above mid-103’s, amid concerns over potential trade-induced economic slowdown.

3. March 11: The 10 year Treasury yield declined, reflecting a flight to quality amid trade policy uncertainties.

4. March 15: The Nikkei index experienced volatility due to global trade tensions and currency fluctuations.

5. March 25: The U.S. Dollar index continued to face challenges, influenced by ongoing trade tensions and shifting market expectations regarding U.S economic performance.

Equities

In March 2025, global markets encountered significant challenges due to escalating concerns about US tariffs, fears of recession, and waning consumer confidence. The anticipation of new tariffs by the US administration in April precipitated a sell-off in US markets, with the S&P 500 experiencing its most substantial monthly decline in over two years. Inflation concerns and a drop in consumer sentiment contributed to this downturn. The Federal Reserve maintained interest rates at 4.25%-4.5%, citing economic uncertainty, but forecasted a 50-basis-point cut later in the year due to lower GDP growth expectations. In Europe, markets turned negative, marking their first monthly decline of the year. Fears of an economic slowdown were exacerbated by impending US tariffs, including a 25% levy on auto imports. European stocks fell to a two-month low, with interest rate decisions from the Bank of England, Riksbank, and the Swiss National Bank adding to investor caution. UK markets also declined due to trade war concerns, a drop in mortgage approvals, and slowing consumer credit. In Asia, most markets declined except for China and India. Chinese markets closed slightly positive in March 2025, driven by attractive valuations, eased tech regulations, the AI boom, and government support. Indian markets saw their strongest monthly rally, fueled by value buying, foreign investor influx, hopes for an RBI rate cut, and robust economic growth. Japan’s market declined, with the Nikkei 225 reaching a six-month low due to fears of US tariffs, levies on the auto sector, sell-offs by foreign investors, and concerns about a global slowdown.

Fixed Income

In March, the Global Fixed Income market experienced volatility due to geopolitical uncertainty and tariff announcements. The rhetoric surrounding tariffs from the Trump administration dampened global growth prospects and weakened consumer sentiments, hinting at a potential recession. US trade policies increased inflationary pressure amidst expectations of a federal rate cut. Treasury yields soared as global indices rallied, with positive performance across treasuries, investment-grade, high-yield corporates, and emerging market debts. Emerging Market Debt (EMD) showed resilience despite trade shocks, with moderate recalibration expected in sovereign spreads. The 10-year US Treasury yields rose due to new tariff announcements and softer economic data, while 2-year yields fell as the Federal Reserve indicated aggressive rate cuts. Consequently, the 10-2 Year Treasury Yield spreads widened, reflecting economic concerns as business sentiments and consumer confidence declined, slowing US growth and negatively impacting global growth. US sovereign spreads tightened in Q1, with High Yield returns lagging in Euros due to a weakening Euro, with high yield spreads for 7-10 years offering diminished returns compared to short maturities. The Federal Open Market Committee kept rates unchanged in March, fearing a global recession might trigger rate cuts. The European Central Bank (ECB) reduced interest rates by 25 basis points to support growth by lowering borrowing costs. Major Asian central banks are expected to follow suit, decreasing rates as most economies are projected to record below-trend and below-consensus growth this year.

Foreign Exchange

The US dollar tumbled in March amid tariff announcements causing uncertainty amongst investors. The Federal Reserve’s hawkish stance amidst uncertainty around the impact of tariffs prompted rates to remain unchanged for a while, broadly pushing the dollar up. However, geopolitical unrest and fears of an economic slowdown led traders to move to other safer havens like gold and the yen. The Japanese yen saw some strength on dollar weakness, appreciating on speculations of more rate hikes by the Bank of Japan as inflation hardens. Additionally, Japanese authorities indicated intervention to reverse outflows and support the undervalued currency, which is currently trading at 150 levels. In Asia, the Chinese Yuan faced downward pressures amid trade tensions with the US. The Indian Rupee gained, rising to a two-month high, on the back of dollar sales from foreign banks. In Europe, trade risks continue to pose a significant challenge for the euro. President Lagarde emphasised that additional tariffs could push inflation up by as much as 0.5 percentage points, derailing the ECB’s efforts to regulate prices. However, Germany’s historical fiscal expansion plans may provide some relief to the euro, but not enough to mitigate the impact of tariffs on the EUR/USD pair. The British Pound remains somewhat shielded compared to the euro, owing to its lower exposure to trade risks. Elsewhere, the Canadian Dollar and Mexican Peso remained vulnerable as tariff hikes are scheduled to commence from 2 April 2025.

Commodities

Precious metals rallied the most last month, largely driven by gold. The yellow metal surged to another record high with prices climbing above $3,100 per ounce in March, supported by growing trade tensions and economic uncertainty. The latest rounds of tariffs imposed by the US on its global trading partners resulted in retaliatory tariffs by China, the European Union, and Canada. Trump’s unpredictable trade policy and renewed fears of rising US inflation have been the key drivers for gold so far in 2025, with year-to-date gains up by more than 19% as of 31 March 2025. Meanwhile, LME copper prices rose by more than 3% month-on-month last month following supply disruptions from Chile and potential US tariff risks. Additionally, the rising arbitrage opportunities between Comex and LME exchanges further supported the upward rally. In the energy complex, US natural gas prices led the gains primarily on constrained storage levels. As of 21 March, total gas stockpiles totalled 1.74 trillion cubic feet, down 24.2% year-on-year and 6.5% below the five-year average. Meanwhile, crude oil prices ended with marginal gains as potential tariff risks were partially offset by concerns about softer demand and rising supply. The OPEC+ group is scheduled to start its first monthly increase of 138,000 barrels per day next month, following its decision to gradually unwind the output cuts of 2.2 million barrels per day by 2026. Lastly, in agricultural commodities, sugar prices rose by 1.8% month-on-month in March, following dry weather conditions in Brazil that led producers and traders to lower cane harvest estimates for the 2025/26 harvest season. Meanwhile, the Indian Sugar and Bio-energy Manufacturers Association (ISMA) reduced its sugar output estimates to 26.4 million tonnes in the 2024/25 season, compared to its previous forecast of 27.3 million tonnes. In the energy complex, US natural gas prices led the gains primarily on constrained storage levels. As of 21 March, total gas stockpiles totalled 1.74 Tcf, down 24.2% year-on-year and 6.5% below the five-year average. Meanwhile, crude oil prices ended with marginal gains as potential tariff risks were partially offset by concerns about softer demand and rising supply. The OPEC+ group is scheduled to start its first monthly increase of 138k b/d next month, following its decision to gradually unwind the output cuts of 2.2m b/d by 2026.

Lastly, in agri commodities, sugar prices rose by 1.8% MoM in March, following dry weather conditions in Brazil that led producers and traders to lower cane harvest estimates for the 2025/26 harvest season. Meanwhile, the Indian Sugar and Bio-energy Manufacturers Association (ISMA) reduced its sugar output estimates to 26.4mt in the 2024/25 season, compared to its previous forecast of 27.3mt.

Outlook

Global markets are contending with significant challenges stemming from recent policy decisions and geopolitical developments. The Trump administration’s announcement of new tariffs, set to commence on 2 April, has intensified market volatility. These measures have contributed to a 5.1% decline in the S&P 500 for the quarter, as investors express concerns over potential inflation and economic slowdown. In response to US tariffs, European nations are exploring increased defence and infrastructure spending, aiming to stimulate economic growth. Germany’s fiscal shift is expected to bolster its GDP by 1.6% in 2026, up from previous estimates. China is cautiously optimistic, with service purchasing manager indices rising, indicating potential stabilisation. However, the real estate sector remains under pressure, and consumer confidence is gradually improving. The OECD projects global GDP growth to moderate from 3.2% in 2024 to 3.1% in 2025, influenced by heightened trade barriers and policy uncertainties. Inflationary pressures persist, with headline inflation expected to decrease from 3.8% in 2025 to 3.2% in 2026 among G20 economies.

Central Bank Quotes

1. “The economy has been growing at a solid pace. GDP expanded at a 2.3 percent annual rate in the fourth quarter of last year, extending a period of consistent growth that has been supported by resilient consumer spending. Recent indicators point to a possible moderation in consumer spending relative to the rapid growth rate over the second half of 2024. Further, recent surveys of households and businesses point to heightened uncertainty about the economic outlook. It remains to be seen how these developments might affect future spending and investment. Sentiment readings have not been a good predictor of consumption growth in recent years. We continue to carefully monitor a variety of indicators of household and business spending.”

– Jerome Powell, Chairman, Federal Reserve (7 March 2025)

2. “Economic growth in Switzerland was solid in the fourth quarter of 2024. The services sector and parts of manufacturing developed favourably. There was a further slight increase in unemployment, while the utilisation of overall production capacity was normal. We expect GDP growth of between 1% and 1.5% for the current year. Domestic demand is likely to benefit from rising real wages and the easing of monetary policy. By contrast, moderate economic activity abroad looks set to have a dampening effect on foreign trade. In this environment, unemployment is likely to continue to rise slightly. We anticipate GDP growth of around 1.5% for 2026.”

– Martin Schlegel, Chairman of the Governing Board of the Swiss National Bank (20 March 2025)

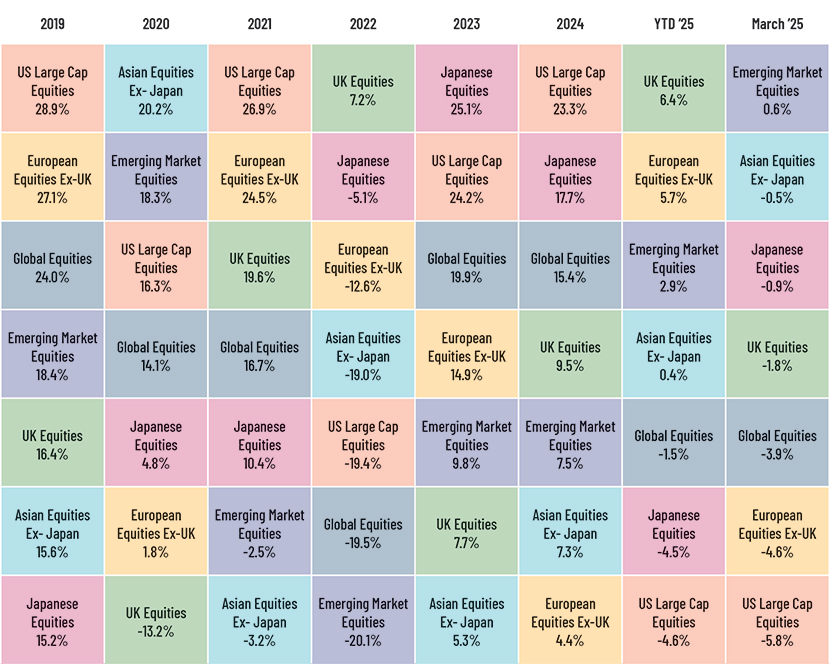

Market Indices*

*Indices are arranged in descending order based on their performance (% gains) during the period. Each colour refers to a specific index, and it remains

In case you missed it

1. Explore how Asset Managers leverage the global talent pool and tech augmentation! – February 2025

The future is now: How asset managers can optimize costs in an increasingly disruptive environment

2. Ready to uncover the optimisation production of Management Report of Fund Performance? – February 2025

MRFP: A case of optimising production of a regulatory document

3. Discover the road ahead for ETF Market Outlook 2025 – March 2025

ETF Market Lens – 2025 Guide to the Evolving ETF Landscape

4. Brace for the importance of investment writing in times of financial crisis! – October 2024

Role of investment writing in times of financial crisis

What’s Ahead

| Date | Country | Event |

|---|---|---|

| Apr 1 | Australia | Interest Rate Decision |

| Apr 7 | Germany | Balance of Trade |

| Apr 15 | United Kingdom | Unemployment Rate |

| Apr 18 | Japan | Inflation Rate YoY |

| Apr 24 | USA | Existing Home Sales |

| Apr 30 | Italy | GDP Growth Rate YoY |

| May 1 | Saudi Arabia | GDP Growth Rate YoY |

| May 6 | Canada | Ivey Purchasing Managers Index |

| May 9 | China | Imports & Exports YoY |

| May 13 | Germany | Unemployment Rate |