Introduction

Executive summary

The global spread of COVID-19 has increased appetite among bond investors for responsible investment options, bringing the “S” in environmental, social and governance (ESG) factors – meaning the social aspect of sustainable investing that depends on factors such as how a company deals with its workforce, the societies in which it operates and the political environment – into the limelight. Precipitated by the pandemic, such responsible investors have identified the need to reduce social risk, increasing the appeal of social bonds vs green bonds as a sustainable financing instrument.

As concepts change, investors are also changing their views on the percentage of proceeds used to finance new projects, rather than simply refinancing old debt, and targeting companies that are changing their focus under responsible management teams

Investors have identified significant opportunities amid the pandemic and are committed to social projects and initiatives. Social bonds have recently emerged as the popular source of sustainable financing and have gained significant traction among issuers and investors. A number of social issues have arisen as a result of the pandemic, turning the spotlight on social bonds, as many investors see these financing instruments as an innovative way to address COVID-19-related issues, while meeting their funding needs.

We believe debt financing through social bonds is set to become a major shift for sustainable investors, backed by a rise in issuance volume. Leading banks now have dedicated teams to provide customised solutions to clients as the banks work towards a “better future for all”.

Acuity Knowledge Partners continues to play a vital role as a valued partner for investment banks by providing a wide range of customised analysis and support, enabling banks to meet growing demand for social bonds.

Why Sustainable Bonds?

Environmental, social and governance (ESG) are the three main factors used to measure the environmental and societal impact of an investment in a company or business. Sustainable bonds have emerged as a popular means of funding, leading to a whole new market the big investment banks can tap. Investors continue to encourage companies to incorporate ESG considerations into their long-term strategies. There are three types of sustainable bonds; Green, Social and Sustainability bonds.

Key differences between an sustainable bond and a conventional bond

Benefits of Issuing a Sustainable bond

Issuer

- Strengthened reputation and publicity

- Viewed positively by regional regulators

- Investor diversification

- Alignment of CSR with funding schemes

- Commitment to social awareness

Investor

- Deeper engagement with company management to ensure alignment with ESG goals

- Investment in a socially important project at or near a commercial rate of interest

- Contribution to a better future

Benefits of Issuing an ESG bond

Sustainable bond – Project workflow

Bond Framework

- Create a bond framework that is aligned to the Green Bond Framework and SDGs and tailored to include all eligible projects/expenditure

- Clear definition of qualifying projects/expenditure that the bond will finance

- There will also be a predefined negative list of projects

- This will align each category of projects to the relevant Green Bond Principles (GBPs)/ Social Bond Principles (SBPs) and relevant Sustainability Bond Guidelines (SBGs)

Governance

- Put in place governance structures to ensure correct project selection

- Put in place a governing body to ensure correct environmental and social risk procedures are followed

- This will require interdepartmental co-operation and coordination

- Clear and transparent governance in SF would mitigate any claims of “greenwashing”

SPO Provider

- Appoint a third party to give a “second-party opinion” (SPO) on an issuer’s bond framework

- The SPO (and annual re-verification) ensures alignment with GBPs, SBPs and SBGs

- Once the SPO is received, the issuer could issue under this framework as many times as it wishes, to the extent of project availability

Bond Issuance

- A roadshow would ensure that investors have time to acquaint themselves with the issuer’s bond framework

- Issuance would happen on a standalone basis or via the issuer’s MTN programme

- Green use of proceeds and specific risk factors and framework-related disclosures to be wired into the bond documentation

Annual reporting

- Annual allocation reporting will highlight the bond proceeds being allocated to predefined projects

- Impact reporting is optional but recommended, as it shows the tangible value of the green bond

- Specific green templates are available for such reporting

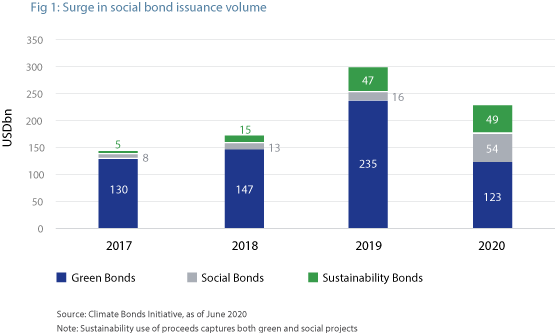

Surge in social bond issuance volume post-COVID-19

Being the youngest member of the sustainable bonds family, social bonds have always remained a small part of the multi-billion sustainable bonds market. However, with a number of social issues arising in the wake of the pandemic, the popularity of social bonds has been surging as majority of the investors see these financing instruments as an innovative way to address COVID-19-related issues, while meeting their funding needs.

Social bonds have enabled issuers to issue bonds with a powerful message and granted access to a broader range of investors with ESG considerations, increasing the appeal of social bonds and issuance volume.

European issuers continue to dominate the social bonds market in 2020

Being the youngest member of the sustainable bonds family, social bonds have always remained a small part of the multi-billion sustainable bonds market. However, with a number of social issues arising in the wake of the pandemic, the popularity of social bonds has been surging as majority of the investors see these financing instruments as an innovative way to address COVID-19-related issues, while meeting their funding needs.

Social bonds have enabled issuers to issue bonds with a powerful message and granted access to a broader range of investors with ESG considerations, increasing the appeal of social bonds and issuance volume.

USD33bn worth of social bonds was issued in April 2020, marking the first month that social and sustainability bond issuance surpassed green bond issuance. The social bond market has gained popularity,

Social bonds issuance volume has already hit record levels in Q2 2020, more than triple the Q1 2020 volume, as the coronavirus crisis increased awareness of social issues related to healthcare and inequality. Alphabet, the parent company of tech giant Google, priced a USD10bn six-part bond, with the 5y, 10y and 30y tranche proceeds will be used to fund green projects, making the combined USD5.75bn three-tranche transaction the largest sustainability bond deal issued in the USD market. The funds will finance new or existing eligible green projects in areas such as energy efficiency, clean energy, green buildings, clean transportation, affordable housing, racial equity, support for small businesses and Covid-19 crisis response. Meanwhile, commodities trader Trafigura Beheer has become the first company to offer a defined Covid-19 premium on an Asian syndicated loan. Social and Sustainability bonds are now 24% and 22% of the total Sustainable bond supply, representing a major structural shift from previous years.

Opportunity: As social bonds gained popularity, the International Capital Market Association (ICMA) updated its Social Bond Principles in June 2020, acknowledging COVID-19-related issues and providing guidelines for eligible social projects such as healthcare and medical research. Before the pandemic, social bonds were used to fund projects related to affordable housing and employment generation, whereas the scope has been widened now for issuers to issue bonds related to the pandemic. Of the USD94bn worth of social and sustainability bonds issued so far in 2020, USD46bn worth relate to the pandemic.

Types of social bonds: The ICMA has identified four types of social bonds, based on eligible social projects, as shown below:

Sovereigns and supranational agencies (SSAs) are leading social bond issuance volume in 2020

The European issuers led the surge in issuance volume, contributing c. 46% of total issuance volume, with French unemployment agency Unedic issued two record social bonds of EUR4bn each in Q2 2020, (as Figure 2 shows). CaixaBank issued a Covid-19 social bond of EUR1bn to finance SMEs and micro-businesses in the most disadvantaged areas of Spain.