ESG research services for private equity and venture capital

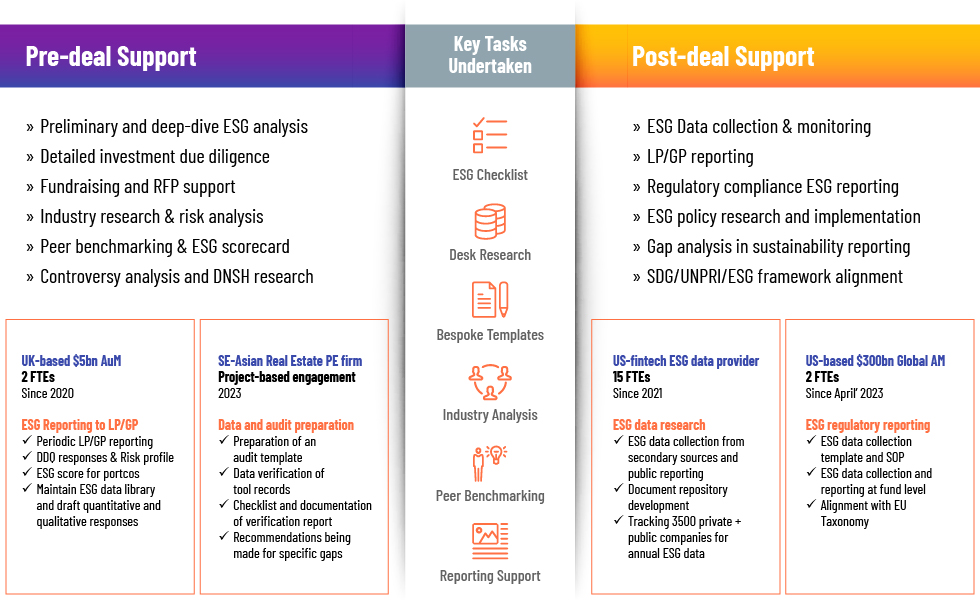

At Acuity, our ESG solutions analysts work as an extension of your team, supporting you at various stages of the investment process to effectively integrate ESG considerations. Our services help private equity and venture capital firms align their portfolios with sustainability goals and meet rising regulatory standards.

Our team is qualified to execute ESG projects from screening and evaluating sustainable investing opportunities to tracking and reporting ESG KPIs, providing tailored solutions to meet our clients’s needs.

They conduct deep-dive ESG research, adopting a top-down, bottom-up or combined approach. ESG solutions for private markets include building databases at the fund and portfolio company level, developing frameworks, modelling, analysis and preparing bespoke reports and presentations.

Who we serve

-

Private Equity and Venture Capital

Private Equity and Venture Capital

-

Consulting and Corporate Firms

Consulting and Corporate Firms

-

Fund-of-funds firms

Fund-of-funds firms -

Alternative asset managers

Alternative asset managers -

Real estate firms

Real estate firms -

Infrastructure firms

Infrastructure firms -

Family house firms

Family house firms -

ESG database and ratings providers

ESG database and ratings providers

ESG research solutions and support we offer

Sustainable investing support

Target screening based on primary ESG mandate

Check investment propositions against ESG policies

Assess opportunities to add value through ESG improvements

Compile checklists to screen for high-level ESG risks

Supporting 10+ UNPRI certified managers with end-to-end ESG support

Due diligence team support

Evaluate investment opportunities from an ESG perspective

Assess quality of ESG management systems

Identify ESG KPIs, risks and opportunities

Competitive analysis/peer benchmarking

Document ESG-related issues for internal use

Winner of Real Deals ESG Due Diligence Awards continuously for the years 2021 and 2022

Portfolio company ESG strategy support

ESG framework and implementation support for portfolio companies

Share ESG objectives and practices with portfolio companies

Prepare ESG performance reports/dashboards framework

Review ESG framework with portfolio companies

Formulate a roadmap for ESG implementation and data collection

Portfolio monitoring and reporting support

Collaborate with portfolio company to set up data collection for ESG reporting

Provide portfolio company with model/framework to monitor ESG practices

Track ESG performance with data gathering and validation support

ESG data analytics support

Prepare ESG reports – bespoke LP reports, LPAC, board meetings, DDQ/LP query support

Maintain ESG dashboards for a portfolio or fund

Periodic maintenance of ESG reports

Compile newsletters

Net-zero and climate research support

Peer benchmarking on net-zero targets and climate related initiatives

Analysis of climate related risks and opportunities

Research support with setting net-zero targets at fund level

How we are different

Domain experts

Advanced monitoring and reporting

Scalability

Stronger service-quality levels

Nearshore capabilities

Multi-language capabilities

Further your ESG goals with our tailored data and technology solutions

Tailored support on integrating data sources, data management to strengthen your ESG framework and accuracy of reporting (Investor/regulatory).

In the News

Environmental Finance

Environmental Finance

What is driving ESG investment in private markets?

Read More Private Equity Wire

Private Equity Wire

Nearly two-thirds of PE and VC firms are planning to raise funds in 2024, with the sector anticipating future interest rate cuts from central banks.

Read More S&P Global

S&P Global