Published on September 18, 2020 by Archana Kanojia

Introduction

It came, it spread, it wrecked.

What started just as news in one corner of the world soon engulfed it. Now, almost half of the year into it, normalcy is still a far cry, with 73% of the respondents (mostly C-suite executives) to an E&Y survey believing the COVID-19 pandemic will have a severe impact on the global economy.

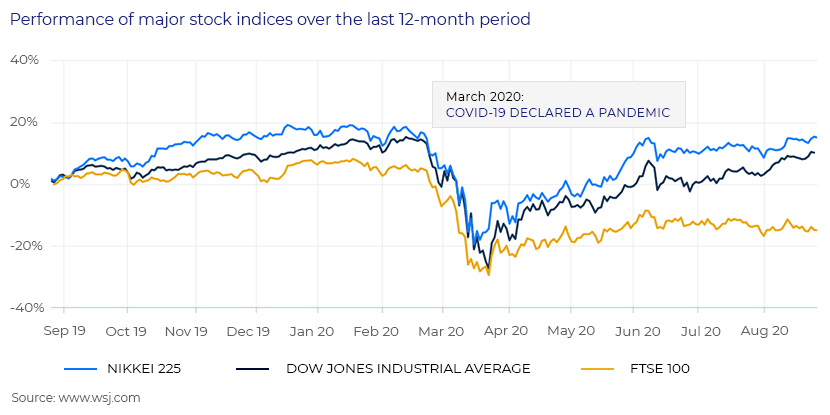

The pandemic continues to take a toll on global economies. The lockdowns imposed by governments to flatten the curve has impacted economic health. The global economy is expected to shrink by 3% in 2020, according to an IMF report, to its lowest since the global depression (1929). Economists forecast that the US economy will shrink 5.9%, the UK 6.5%, Germany’s 7% and Japan’s 5.2%. The cracks are just beginning to emerge.

Impact on private equity

Private equity (PE) activity has not remained unscathed. PE firms spent the first few months of the pandemic trying to keep steady against the unprecedented blow. They engaged in constant communication with the management teams of their portfolio companies to gauge the impact of the crisis on their performance. They were simultaneously in constant communication with limited partners (LPs), ensuring them of the safety of their investments and trying not to lose investors or having to deal with LPs’s requests for redemption of their interests.

PE activity (such as fundraising and deal-making) slowed amid the outbreak as PE firms tried to safeguard their portfolios from adverse impacts by dis-engaging from fundraising and exiting their investments

Impact on PE exits

The repercussions of the pandemic are now becoming visible after half a year of its outbreak. With uncertainty around how long the pandemic will last and reduced deal activity, PE valuations have taken a hit. Companies that appeared to be lucrative investment less than a year ago have suddenly become pain-points. PE investments in companies in the service sector, such as hospitality and energy companies, have been hit particularly hard.

While PE firms continue to evaluate their losses and portfolio investments amid the chaos, PE exits have been deprioritised. PE exits dropped by 70% in May 2020 according to McKinsey research, versus May 2019. In additional, the value of PE exits dropped to USD1.9bn, a 69% decline from 2H 2019.

It is uncertain how things will be when they return to “normal”. McKinsey conducted a survey of more than 40 sponsors, CEOs and investment bankers to gauge sentiment as to when conditions are likely to be conducive for normalised economic activity and PE exits. The timeframe was 6-18 months.

With declining economic activity, scheduled PE exits have been put on hold. PE firms are also reluctant to sell off their holdings given market volatility and investor sentiment, at least in the next 12 months. According to a survey conducted by Investec, 80% of the PE firms surveyed stated that they do not intend to exit their portfolios over the next year.

How PEs can prepare for an exit

The pandemic has put economies and industries on a defensive footing, continuing to monitor the situation and plan accordingly. An E&Y survey found that while 54% of respondents (C-suite executives) expect a U-shaped recovery, 38% forecast a V-shaped one 8% an L-shaped one.

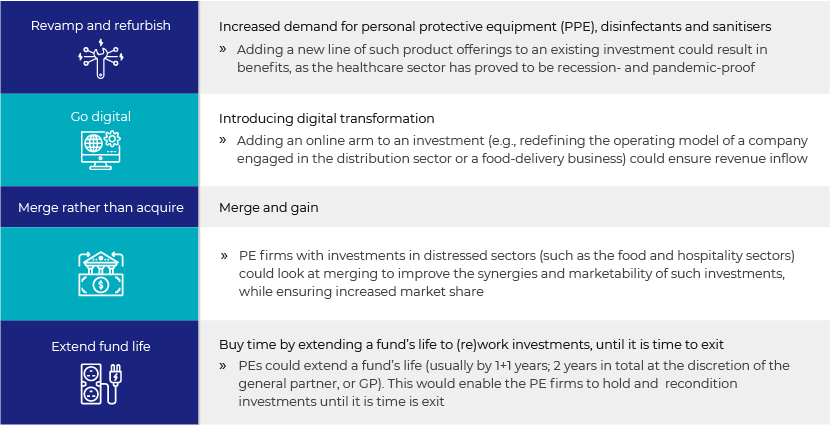

PE managers usually spend around 3-5% of their time planning for an exit. However, given the current market volatility, they are deferring their exits and using the extra time on their hands to prepare and plan for a future exit in one of the following ways:

This additional time afforded to a PE firm is an opportune time for it to prepare its investments for (future) exit. This is because, once the situation normalises, needs and demands of investors (or end consumers) and market sentiment will change. Now is the time for PE firms to re-strategise and identify areas of growth in its portfolios to increase their (future) market value, and also to meet redefined market demand in time to come.

How Acuity Knowledge Partners can help

Our teams have been working as natural extensions of our clients’ teams. Our service offerings to PE clients include collateral management support, presentation updates, secondary research, newsletters, ad hoc work (as per client requirements) and RFP writing support.

For more relevant offerings, please visit our solutions page.

To help our clients navigate both the people and business impact of the crisis, we have created a dedicated hub of topics, including our latest insights, thought-leadership content and action-oriented guides and best practices.

Sources

McKinsey report (June 2020): Preparing for private equity exits in the COVID-19 era

E&Y report (March 2020): How do you find clarity in the midst of the COVID-19 crisis?

Tags:

What's your view?

About the Author

Archana Kanojia started her career with Acuity Knowledge Partners in 2010. She currently provides oversight to various teams assisting client business development teams’ in proposals drafting, managing proposal content, lead generation and consultant databases. Previously, she provided oversight to teams that assisted clients to set up fund databases for private equity funds of funds, analyzing private equity (PE) firms and their funds from an investment standpoint, and also extended investment support to PE firms through industry studies, information memoranda and similar activities.

Archana holds a Post Graduate in Business Management with a specialization in Finance and Marketing from New Delhi Institute of Management, Delhi. She..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox