Published on May 19, 2020 by Rohit Tyagi

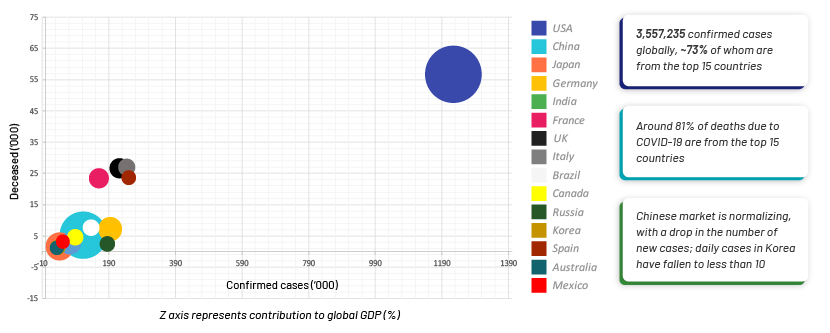

As COVID-19 spreads across the world, number of confirmed cases crossed 3.5 million with over 0.2 million deaths. China has reported a fall in the number of new COVID-19 cases for the first time to ‘below 10’ in the first week of May 2020. However, it continues to witness new infections as people return back to China.

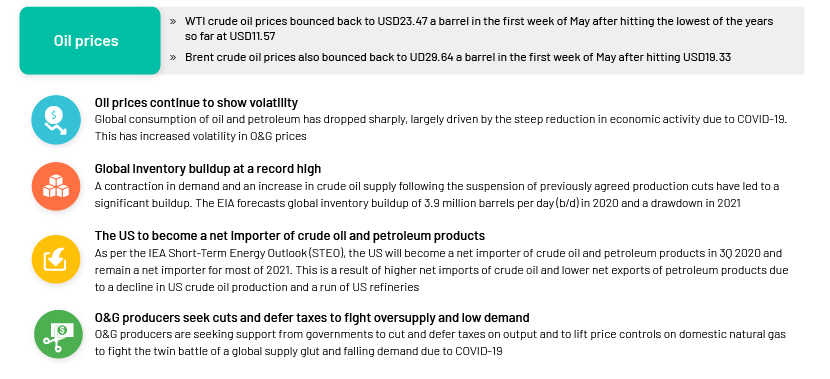

Oil prices have continued to drop as demand reduces due to COVID-19. Oil prices hit their lowest in 1Q of USD20.09 per barrel (WTI) and are still showing high volatility. Overall, energy companies are seeking support from governments to offer payment breaks to large consumers struggling to pay bills amid the COVID-19 crisis.

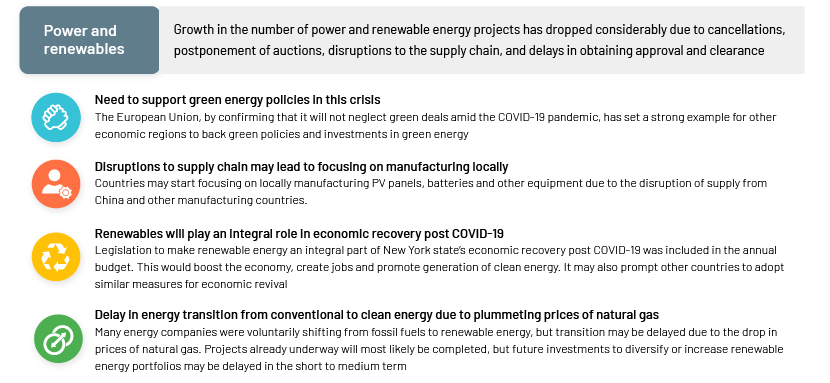

Amid COVID-19 related disruption in the energy sector, we think that renewables can play an integral role in reviving an economy. Hence, the sector will likely attract new investments and potentially create new jobs through suitable policy and legislative support. Also, the disruption in supply from China would lead countries to focus on locally manufacturing of PV panels, batteries and other equipment in the long run.

Below are 5 charts that summarize the world scenario in the Energy sector:

Status of COVID-19 crisis in the top 15 countries (contributing more than 75% of the world’s GDP) as of 5th May, 2020

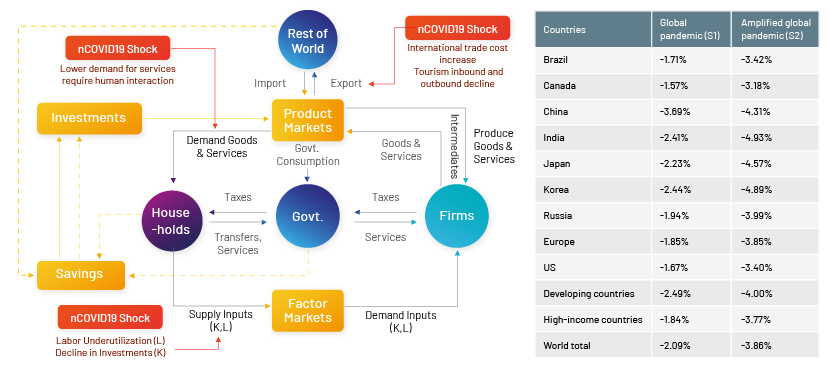

Based on the World Bank’s preliminary assessment, the potential impact of COVID-19 on global GDP in illustrative scenarios is 3.9%

Impact on Oil prices

Impact on Power and renewables

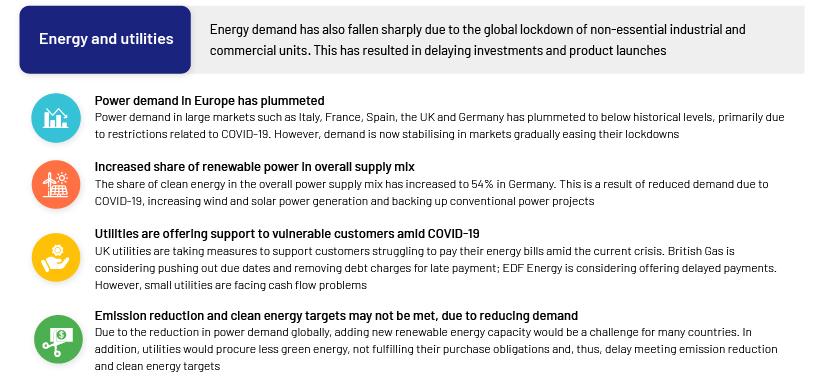

Impact on Energy and Utilities

Based on an assessment of the global energy market amid the COVID-19 crisis, the following are our recommendations for energy companies to weather the situation.

-

-

Operations

-

Review capital reserves and corporate budget to see how low energy prices (oil and gas) can support profitability and cash flow generation

-

-

Manpower

-

Automate tasks to minimise person-to-person contact and focus on training and capacity building to add new skills and improve productivity

-

-

Customers

-

Boost customer confidence by, for example, offering payment breaks and reward programmes, adopting new pricing strategies and increasing online engagement

-

-

Investments

-

Cash-rich companies could look for M&A opportunities to acquire distressed businesses in new and emerging markets in a business-as-usual scenario

Adapting to the new normal

We believe COVID-19 will have a deep impact on how we do business around the world. Energy and Utility firms will need to be agile to adapt to this new normal of business as they rethink their strategy for 2020.

Here is where Acuity Knowledge Partners can help you navigate through these challenging times. Our global offices can enable you to handle business demand and uncertainties with ease. Currently, we are helping many of our clients with our understanding of the market to chart their 2020 strategy.

To help our clients navigate both the people and business impact of COVID-19, we have created a dedicated hub containing a variety of topics including our latest thinking, thought leadership content and action oriented guides and best practices.

Tags:

What's your view?

About the Author

Rohit is a key member of Acuity’s Consulting and Corporate team, bringing 14+ years of experience in strategic consulting. He possesses proven expertise in the planning, management, and execution of complex projects, with a particular focus on driving energy transition, advancing renewables and clean technologies, and promoting sustainability initiatives.

He specializes in the implementation of sustainable strategies across Europe, APAC, and MEA. Proven insights in emerging markets including Green Hydrogen, CCUS, Renewables, EVs, Energy Storage, and Carbon markets, among others, enable him to provide informed guidance to clients from diverse sectors including Power, Steel, Cement, and Infrastructure.

Rohit's experience includes collaborating with a wide range of stakeholders, from investors to..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox