Published on February 1, 2019 by Binayak Ransingh

The 2015 United Nations Climate Change Conference in Paris accelerated the integration of renewable energy sources into the electric grid. Progress toward de-carbonization has also been supported by the sharp decline in renewable energy costs.

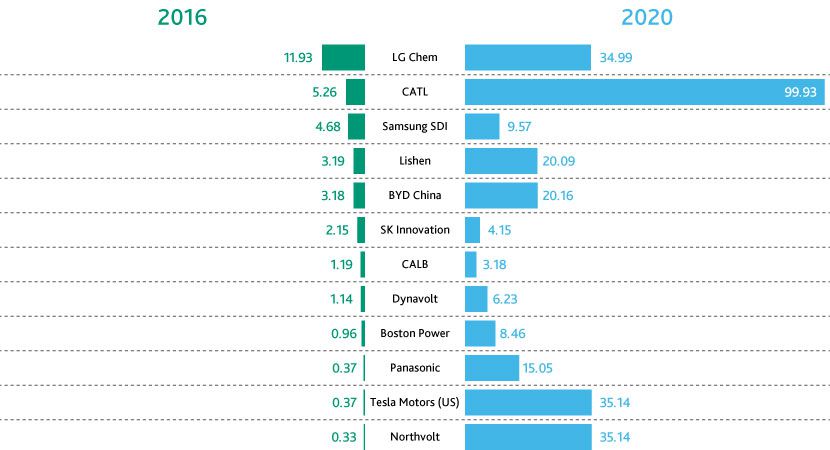

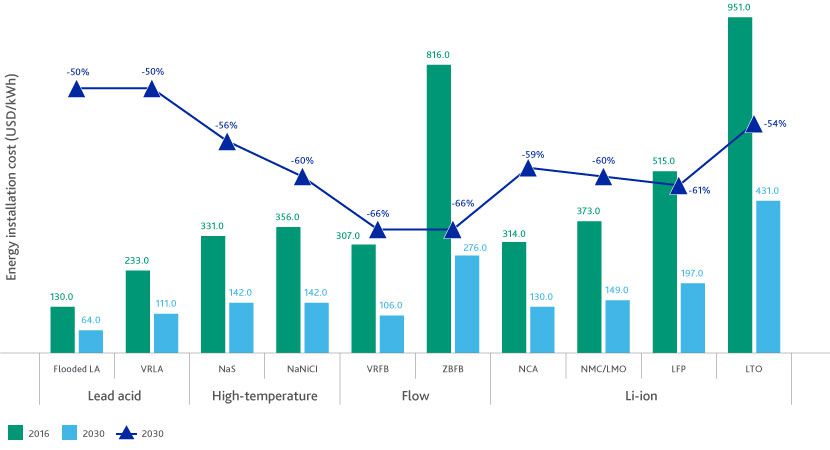

Companies aim to minimize the cost of batteries by focusing on the use of large facilities to benefit from economies of scale and by focusing on continued innovation and improvements in technology.

Demand for a more flexible electric system has increased in recent years as the share of renewable energy in the energy generation mix has increased. Hence the exponential increase in demand in countries dependent on renewable energy to integrate electricity storage systems into the electric grid. Storage in batteries and other advanced technologies will help to achieve increased flexibility in the power transmission and distribution system. It would also facilitate electrification of the transport sector (through the adoption of electric vehicles), enable use of 24-hour off-grid solar home systems and support a mini grid based 100% on renewable energy. Such an energy storage system would also enable the grid to respond immediately to sudden growth in demand.

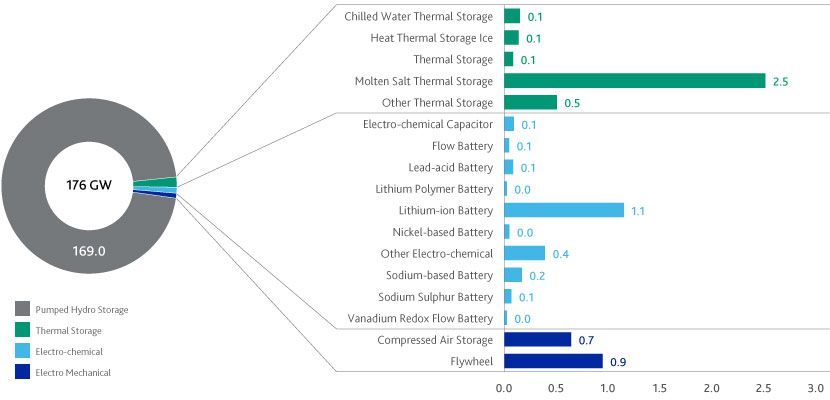

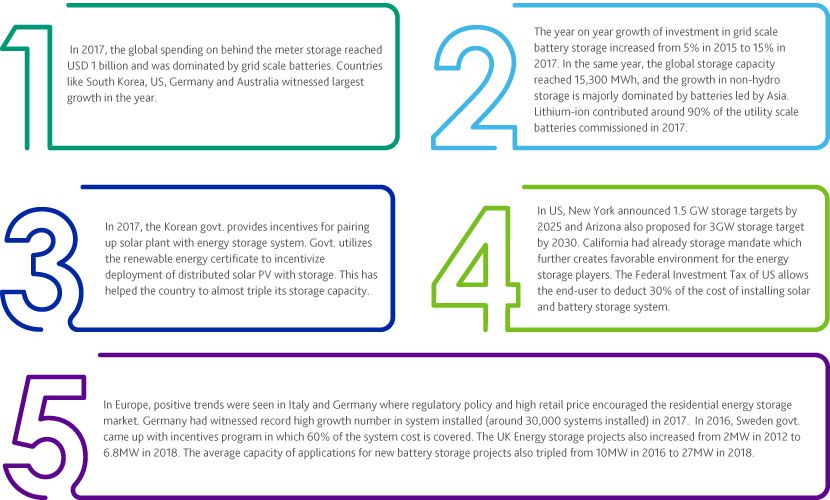

South Korea, the US, Germany and Australia dominate the grid-scale battery market

Major business activity in the ESS market

Tesla and its Gigatalks

Tesla has played a key role in the lithium-ion battery segment. Known for introducing the term “gigafactory” to the industry, it recently confirmed that its Gigafactory 1 had achieved battery production at 20GWh. It is focused on minimizing battery costs through economies of scale, innovative manufacturing, reducing waste, and optimization by integrating major manufacturing processes under one roof. It reported a significant achievement in 2018, when it met its ambitious deadline to set up a 100MW/129MWh energy storage system in 100 days. The project provides grid services through its battery system and has saved around USD40m in the past 12 months.

Automotive OEMs enter the energy storage business

The use of electric-car battery packs in large-scale energy storage projects is becoming popular. This provides automotive OEMs an opportunity to participate in the energy storage market and to create a new smart electric ecosystem that facilitates energy transition. Renault has initiated a new “Advanced Battery Storage” program under which it plans to build by 2020 the biggest stationary energy storage system using all electric-vehicle (EV) batteries ever designed in Europe. It sold its Zoe EVs while retaining ownership of the battery packs. It plans to use the second life of EV batteries to install 60MWh of energy storage capacity across Europe. Daimler’s subsidiary Mercedes-Benz partnered with ENERGIE and The Mobility House to turn a coal power plant into a large energy storage facility, using thousands of modules from its EV battery packs. BMW also entered the market by connecting its i3 battery packs to the UK’s National Grid. The project comprises six shipping container-size units, five of which contain 500 i3 battery packs, each with 33kWh capacity. The company also installed 1,000 i3 battery packs for an energy storage project at a wind farm near Amsterdam. Nissan has unveiled a stunning standalone streetlight powered by used Leaf battery packs and solar energy.

The use of electric-car battery packs in large-scale energy storage projects is becoming popular.

Energy storage implementation in end-user industries

Transition to green energy is not limited to the energy sector; it sees a large adoption rate in other energy-intensive sectors as well. Global collaborative initiative RE100 has united influential businesses to ensure 100% renewable energy utilization for their processes. This has created demand for 188TWh of renewable energy from 155 industry participants. The development of green businesses is, therefore, also likely to create a significant opportunity for the energy storage market to provide reliable renewable power to energy-intensive projects.

Amazon, the leading multinational technology company, was also a leader among corporate purchasers of renewable energy in the US in 2016. It plans to power all its facilities using 100% renewable energy in the long term. It recently started working with Tesla to deploy Tesla’s energy storage system at its distribution centers. The last project completed was a 4MW solar array and 3.77MW battery system at Tilbury Fulfilment Centre in London.

2030 outlook

A diversified portfolio for the ESS market

Technological constraints dictate that a single type of storage system be used for multiple applications. For example,

-

Most electrochemicals-based storage systems (c. 50%) are used for frequency regulation, followed by electric supply spinning reserve capacity

-

Electromechanical relay-based energy storage systems are mainly used for onsite power supply (around 55%), followed by black start processes

-

Thermal storage systems are used widely for renewables capacity firming and energy time shifting

Use of a single type of technology makes it difficult for ESS players to provide different services and generate multiple revenue streams. We expect this technological barrier to structure the ESS market such that it will have a diversified portfolio by 2030. Growth in battery demand, because of the increasing share of renewable energy in the energy generation mix, has contributed to the drop in battery module costs, but battery storage systems will likely compete with other options such as dispatchable renewables (bioenergy, biogas, concentrated solar power, reservoir hydropower to gas or power to hydrogen).

We expect the increased integration of renewable energy sources into the electric grid and increasing demand for de-carbonization from end-user industries to drive the global ESS market and to create economic opportunities for the sector. The International Renewable Energy Agency (IRENA) estimates that the share of renewable energy in the energy generation mix will be 80% by 2050, with solar PV and wind power contributing 52% of total electricity generation. It expects electricity storage capacity to grow from 4.67TWh in 2017 to 6.62-7.82TWh (according to the REmap 2030 Reference Case) and 11.89TWh to 15.27TWh (according to the REmap Doubling Case) by 2030. Hence, electricity storage will be at the heart of the energy transition process, providing services across the power system value chain and to different end-user segments.

Battery storage systems are also likely to compete with other options such as dispatchable renewables

Acuity Knowledge Partners Energy & Utilities team has actively supported its energy-sector clients with high-value research, analytics and business intelligence. Such support helps our clients to adapt to changing business dynamics in the energy sector, driving revenue growth.

Bibliography

-

Electricity Storage and Renewables: Costs and Markets to 2030, International Renewable Energy Agency

-

Energy Storage for the Grid: Policy Options for Sustaining Innovation, MIT

-

A Vision for Energy Storage, Energy Storage Association

-

Company websites

What's your view?

About the Author

Binayak Ransingh is an Energy & Utilities practice lead in Acuity Knowledge Partners’ Private Equity & Consulting vertical. He has over six years of experience in the power and utilities sector, helping clients with various consulting and business research projects involving market assessment & intelligence, competitive benchmarking, market entry & expansion strategy, technology impact analysis, and business model analysis. Binayak holds an MBA in Power Management and a bachelor’s degree in Power System Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox