Published on January 5, 2021 by Nikita Chhabra

Breakneck pace of high-yield issuances in 2020

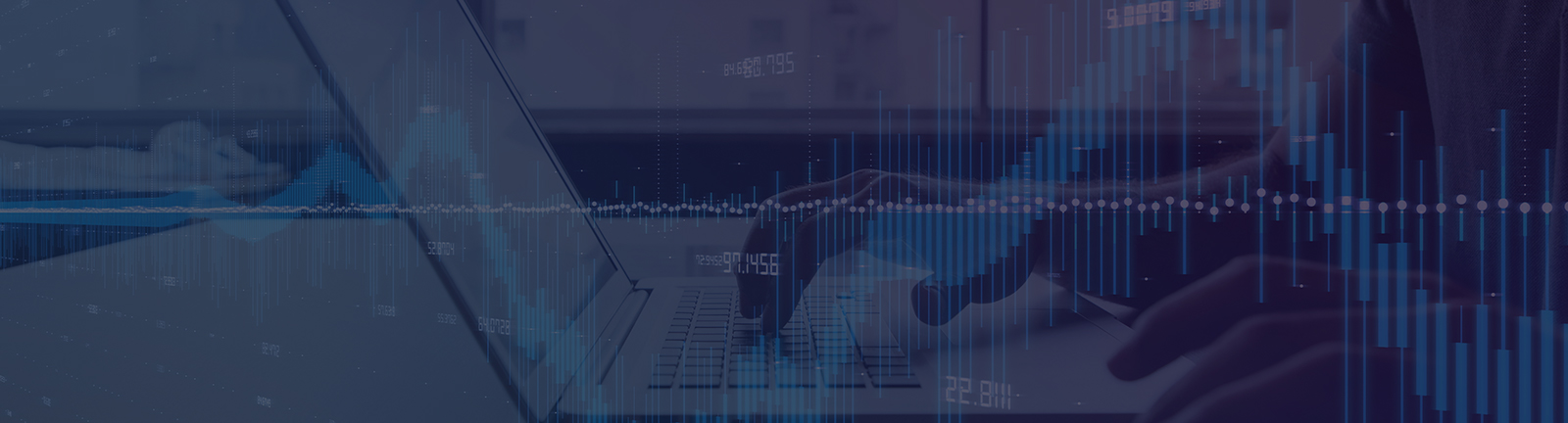

High-yield bond issuances have amounted to c. USD330bn so far this year (breaching their eight-year record), growing a staggering 40% YoY. Despite nine months into the COVID-19 pandemic, demand for junk bonds was unusually high in October, exceeding USD34bn. In terms of issuance volume, oil and gas held the highest share, followed by technology, media, healthcare, and professional and business services.

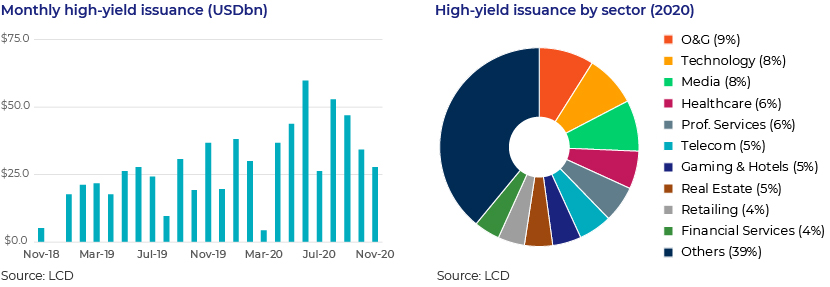

Airlines, cruise operators, and hotels, among other sectors, that became the biggest causalities of the pandemic sourced financing via junk bonds in 2020 to stay afloat. As evident in the graph below, the jump in junk bond issuances is particularly sizeable in the aforementioned sectors.

Evidently, in 2020, secured high-yield issuances gained preference over unsecured issuances, given the general weak economic backdrop.

What is driving all this activity?

Much of this buzz is attributable to the Federal Reserve’s (Fed’s) launch of the secondary market corporate credit facility (SMCCF) in response to the pandemic. Using this facility, the Fed will purchase USD250bn of corporate securities to enable the smooth functioning of credit markets in the US. While total purchases in this programme have been an abysmal USD15bn to date, the Fed’s active participation and mammoth size of the overall credit facility have instilled confidence in the markets. Continuing its resolve, the Fed extended the SMCCF to 31 December 2020, earlier slated to expire on 30 September 2020.

Will the high-yield buoyancy last, or are all good things short-lived?

Defaults expected to edge higher

Moody’s and S&P Global estimate the default rate for junk US bonds in double digits (c. 12%) in the beginning of 2021. This is practically three times the historical median rate of defaults (c. 3.7%), underlying the COVID-19-driven weak economic climate, which will likely make many firms insolvent. The high-default-rate expectancy is attributable to the current winter-driven flare-up in COVID-19 infections, as governments worldwide once again have to balance between keeping the economy open and containing the spread of the virus. The impending expiry of several labour support programmes, which will likely jeopardise business continuity plans for many firms, will add to the default burden.

The Fed’s role is important, but it has its limitations

As the default trajectory unravels in the light of the ongoing pandemic, the Fed’s facilities are unlikely to cushion all sub-sectors of the market. To this end, Citigroup’s latest report on the Fed’s bond-buying programme shows significant reduction in the capital deployed by the apex institution in the high-yield market. Against the backdrop of the pandemic and waning Fed support, the market expects energy, capital goods and retail, among other sectors, to receive the most severe blows.

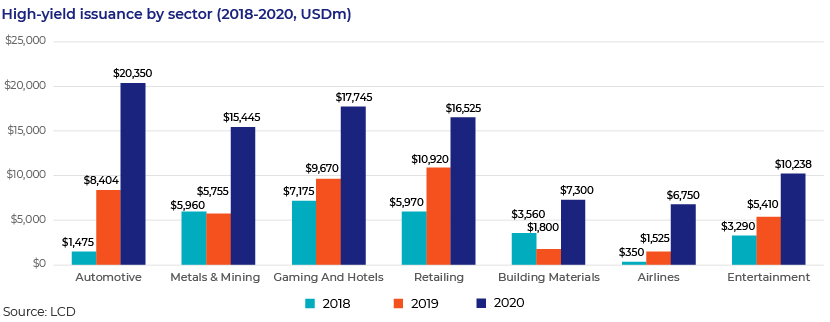

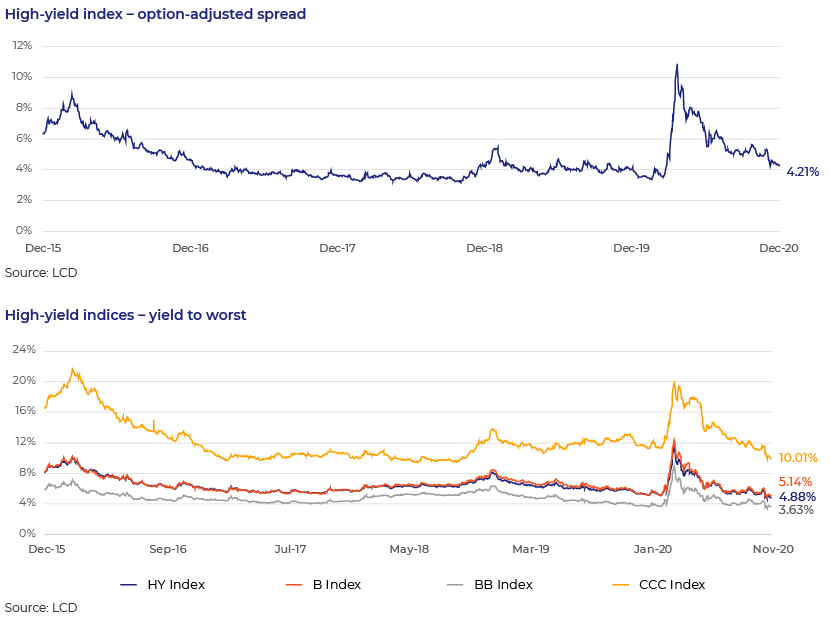

Existing junk bond spreads do not mirror underlying market risks

Spreads in the junk bond market have narrowed to the long-term average of c. 4%, in sharp contrast to a spike in yields at the onset of the pandemic in the US, prior to the Fed’s intervention. While the Fed’s involvement has been crucial in narrowing spreads in the credit market and propping up bond prices, it has created a unique bubble. Existing bond yields and prices do not give an impression of the underlying economic situation in the market. Investors are pricing in the burgeoning corporate debt burden and likelihood of bond defaults at a minimal premium and are, therefore, oblivious of reality. To this effect, a notable example is the junk bond issuance of Ball Corp. at a benign c. 3% coupon for a decade-long maturity. Another case in point is yields on the riskiest CCC-rated bonds, which reached their lowest levels in November, a level last seen in 2018, when economic conditions were normal. In the medium term, as the Fed pares its support, market spreads will inevitably undergo several course corrections since they have not factored in the economic aftereffects of the pandemic.

Troubled waters ahead

In a nutshell, the current weak economic climate is adding steam to the high-yield default situation. Also, based on the Fed’s recent passive involvement in the markets, one can forecast that the spreads are likely to undergo several corrections and the robust high-yield issuance witnessed in 1H20 will eventually taper off. All in all, it is time credit investors came to terms with the balance sheet stress currently faced by high-yield issuers and finally start looking closely at solvency risks surrounding their investments.

About Acuity Knowledge Partners

Acuity Knowledge Partners is a leading provider of high-value research, analytics and business intelligence to the financial services sector. We support over 300 financial institutions and consulting companies through our specialist workforce of over 3,000 analysts and delivery experts across our global delivery network.

Sources

https://www.nytimes.com/2020/07/09/business/high-yield-bonds-coronavirus.html

https://www.jdsupra.com/legalnews/high-yield-bond-activity-continues-to-24275/

https://www.ft.com/content/5bdfe3a6-8a13-4039-bc81-07a22ba85123

https://www.barrons.com/articles/junk-bond-yields-just-reached-a-record-low-51605026018

https://www.bloombergquint.com/gadfly/junk-bonds-recent-gains-tell-deceptive-story

What's your view?

About the Author

Nikita Chhabra is a part of the Investment Banking team at Acuity and currently works for a prominent boutique investment bank in the US. She has a total work experience of over 6 years and has rich exposure working on a variety of research and analysis assignments serving clients ranging from top asset managers, PE firms to bulge bracket investment banks.

Nikita holds an MBA in Finance and a Bachelor’s degree in Commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox