Published on December 18, 2020 by Ambarish Srivastava

Private equity (PE) is well-poised to navigate through the difficult economic conditions created by the COVID-19 crisis. Although pandemic-related disruptions decelerated global PE deal activity, the sector is beginning to rebound slowly.

As with deal activity, PE fundraising declined 17% from 2019; however, the USD400bn fundraising in the first three quarters of 2020 is in line with previous years. Technology-focused PE fundraising appears to be increasing more than ever, with over USD50bn deals closed or allocated to tech-focused, US-based PE funds in 2020. Although firms are investing heavily in digital transformation, an increase in investor demand, lack of internal bandwidth and limited options in terms of managed solution providers are delaying technology initiatives.

Trend #1 – PE deal activity has declined, leading to a further pile-up of dry powder

-

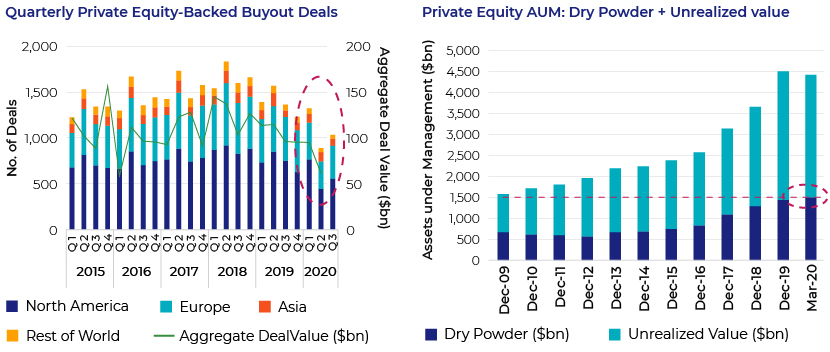

Overall, global buyout activity decelerated 22% y-o-y to 3,373 registered deals YTD (September 2020) for a combined value of USD260bn, due to logistical and operational restrictions as a result of the lockdowns imposed in many countries and macroeconomic uncertainties, which weighed on the market as a whole. This slowdown in deal activity has put pressure on managers to deploy a record amount of dry powder of USD1.7tn as of July 2020, increasing progressively from USD1.4tn in 2019 to USD1.5tn in 2Q20 . This dry powder is likely to remain aloft for another quarter or two.

-

With internal travel resuming slowly and lockdown restrictions being lifted, deal activity is beginning to pick up, evidenced in higher 3Q20 numbers vs 2Q20 (2Q20 witnessed the lowest deal value since 2015).

-

The number of deals in the first three quarters of 2020 declined in all regions globally; the rebound in deal value was driven by an increase in the average deal size (USD83m in 3Q20 from USD63m in 2Q20).

-

In the first three months of 2020, PE deal values declined in the US and Europe by 25% and 33%, respectively, whereas Asia witnessed a massive recovery (bounced back in 2Q 2020 itself), with deal values increasing more than 25% in the same period.

Source: Prequin

Trend #2 – PE fundraising volumes decline at an accelerating pace, reflecting the continuing pre-pandemic trend of capital consolidation

-

As per Preqin, 237 funds closed in 3Q20 (a decline of 45% from 2Q20), the fewest since 2015. Total capital secured held up relatively well, with USD400bn raised by PE funds in the first three quarters of 2020, representing a decline of 17%.

-

However, the average fund size grew to USD536m, a 26% increase compared to 2Q20, indicating commitments are flowing to larger funds, as investors seek security in larger renowned fund managers. The pre-pandemic trend in capital consolidation is likely to continue, as established fund managers continue to enjoy more success and increase their market share.

-

This trend is more notable in Europe, where the average fund size was USD1.7bn in 3Q20, compared with USD364m in North America and USD254m in Asia.

Trend #3 – COVID-19 has exposed the inefficiencies in private market infrastructure, stressing the importance of implementing digitisation throughout the investment life cycle

-

Just as everyone else, general partners (GP) are facing COVID-19-related disruptions, including switch to remote working and travel restrictions, especially in conducting operational due diligence (onsite and in person). The pandemic has reiterated the importance of data, systems and capacity throughout private markets, forcing GPs to reevaluate their existing processes and be more open to relying on digital operations (digital due diligence) for material contracts, legal documents, financial health, supply chain, risk management, employment, management/governance, insurance policies, regulatory approvals and filing.

-

To mitigate the effect of travel restrictions, PEs are leveraging their industry as well as global and localised network of trusted advisers and partners for additional insights.

-

With little to no travel, LPs and GPs now have more bandwidth to evaluate new opportunities and establish new relationships.

Trend #4 – TMT and technology sectors, in particular, are expected to drive PE deal activity

-

The technology, media and telecom (TMT) sector continues to be a focus area for PE firms, despite negative sentiment and impact on deal activities due to the COVID-19 pandemic. The current market situation has led to the faster adoption of new technologies by companies and contactless purchasing and human resource management. This trend is clearly visible in several sectors. Consequently, PE firms’ focus on the technology sector is also likely to increase, which could lead to more early-stage and growth investments.

-

TMT deals plummeted in the first half of 2020; however, the sector showed more resilience compared to other sectors in 3Q20. Among the sub-sectors of the TMT industry, technology recorded high investment volumes. In the first three quarters of 2020, nearly 20% of all US PE buyout deals, representing more than 30% by deal value (vs 19% in the same period in 2019), took place in the tech sector, the highest PE investment in any sector. This trend was noted in Europe as well, with technology sector deals accounting for 30% of the total deal volume in 3Q20 (up from 17.5% in 3Q19).

Trend #5 – PE companies are focusing on complete technology solutions in data operations and portfolio monitoring

-

PE firms are facing numerous challenges owing to the limited availability of technology applications in the market to deal with complex data operations in direct PE, complex secondaries and private credit space. Although firms are investing heavily in digital transformation, an increase in investor demand, lack of internal bandwidth and limited options in terms of managed solution providers are delaying technology initiatives. Going forward, PE firms will invest more time and fund in technology applications, process enhancement and automation.

Trend #6 –The PE secondaries market is growing increasingly

-

Financial market turmoil is expected to drive growth in the secondaries’ market, as the demand from distress investors increases, liquidity crunch in mid-segment PE heightens and investors (LPs) look to offload their positions to rebalance their portfolios. As per a survey conducted by Preqin, the proportion of investors seeking to deploy capital in secondaries has increased 28% in the past year.

-

Secondaries is the only strategy in private markets that witnessed a c.200% increase in capital raising in 2020 (trailing four quarters’ growth), reflecting increased investor interest.

-

Smaller PEs focused on mid-size companies will face further challenges owing to demand and supply shocks, leading to delays in exists and push for extension in fund liquidation. Secondary investors are likely to have more opportunities in the coming quarters. Many secondary players are looking for strategic primaries to access quality deals in the future.

-

However, complex secondary transactions, multi-fund coverage and real-time valuation will be major challenges owing to the highly specialised nature of the business.

Trend #7 – Adoption of environmental, social and governance (ESG) is increasing in private markets

-

ESG has garnered significant traction in the private equity industry in recent years, driven by increasing demand and pressure from limited partners to incorporate ESG considerations in investment and reporting processes. An increasing number of GPs are taking into consideration the fact that having strong ESG credentials can act as a key competitive advantage in attracting investment from LPs. As per a survey by PERE, 78% of LPs consider ESG factors when selecting a PE fund to invest in.

-

The global pandemic has increased the focus on ESG factors, and the trend is likely to gain momentum. In the first two quarters of 2020, ESG investment increased significantly. According to BlackRock, 88% of sustainable funds outperformed their non-sustainable counterparts between 1 January and 30 April 2020.

-

PE firms will increase their focus on impact investments covering many sectors such as health care. In addition, they will operationally support their portfolio companies in implementing the ESG framework, guidelines and reporting of ESG data.

Tags:

What's your view?

About the Author

Ambarish has about 19 years of experience in business research, analysis and consulting. He is engaged in leading deep-dive strategic projects, due-diligence support, issue-focused trend analysis and similar assignments for our Private Markets clients. His previous experience includes tenures with startups, the Big Four and consulting organisations, where he focused on industry studies, price forecasting, company analysis, macroeconomic studies and other strategic engagements.

Like the way we think?

Next time we post something new, we'll send it to your inbox