Published on April 21, 2021 by Arnab Banerjee

The public, media, experts and analysts now talk about the world before the pandemic and the one since. Things have changed significantly in most spheres of life – some for the good and some for the not-so-immediate good.

In terms of economies, we have seen multi-layered and both short-term and long-term impacts on global economic structures and consumer behaviour. Heightened uncertainty led to a drop in consumption and investment by consumers, investors and international trade partners. The global economy was concerned about the impact of a US-China trade war and the US presidential election, and a number of sectors have been impacted in recent months. With the development and emergency approval by the US Food and Drug Administration (FDA) of the Pfizer COVID-19 vaccine and the focus shifting to vaccination programmes as other vaccines jump on the bandwagon, can we expect the scenario to change now, and if yes, how much? With gradual improvements in consumer sentiment and confidence, the sectors most severely affected – such as air travel, tourism, sports, events, entertainment, education, real estate, hospitality and oil – have started to recover gradually and may see a slight increase in demand in 2021. While the healthcare sub-sectors – such as medtech, life sciences and pharma – have seen mixed impacts, in this note, we will mainly be analysing the pharma subsector and its components.

Analysing how the large pharma companies have fared since the start of the pandemic gives us a clearer picture

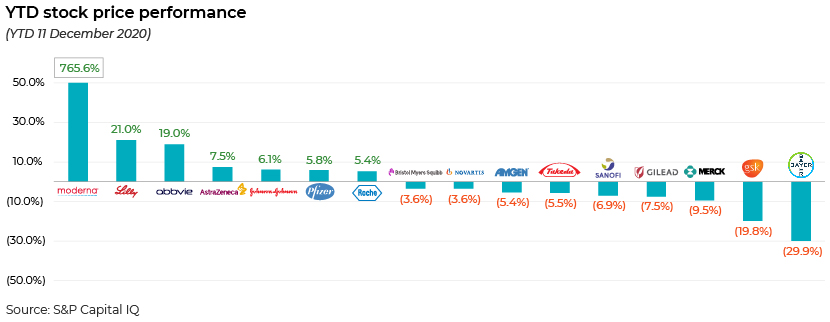

We analyse the stock price performance of the same set of companies over two time periods: one since the start of the pandemic until December 2020 (which we refer to as of 11 December 2020), which is around the time the first emergency approvals for COVID-19 vaccines were received. Stocks of those pharma companies engaged in developing vaccines rallied. There are more than 425 candidates for COVID-19 therapeutics in the pipeline.

YTD 11 December 2020 stock price performance of the large pharma players

The YTD performance to 11 December 2020 clearly aligns with market expectations related to vaccine development. The winners were Moderna, Eli Lilly, AbbVie, AstraZeneca, Johnson & Johnson, Pfizer and Roche – the frontrunners in the COVID-19 space. Pfizer’s share price grew 11.1% from 30 November to 8 December 2020. In contrast, companies such as Bristol Myers Squibb, Amgen, Novartis and Bayer – large pharma companies that did not focus on COVID-19 candidates – reported a negative performance. Companies such as Johnson & Johnson, Sanofi, GlaxoSmithKline and Merck & Co. had COVID-19 candidates in their development pipelines but were lagging in terms of expected approval at the time. (Johnson & Johnson received emergency approval in February 2021.) Sanofi and GlaxoSmithKline expect approval later in 2021, whereas Merck & Co.’s candidate is still in the early stages of development.

The second time period: is the COVID-19 pipeline an apparent game changer for pharma companies or not?

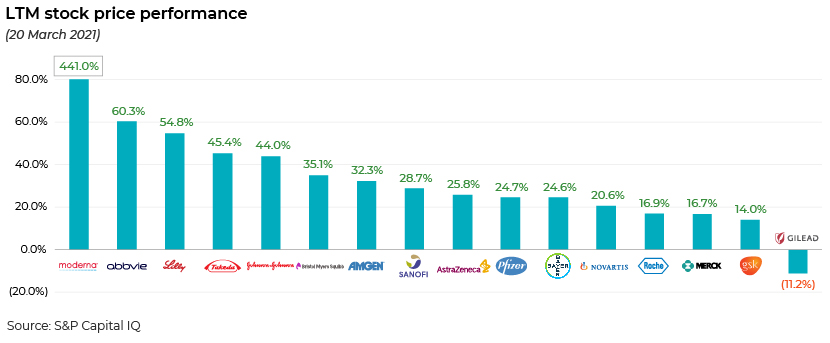

The LTM stock price performance of the same set of companies shows that those companies that were initially punished by market sentiment have now normalised on the back of long-term, more sustainable prospects.

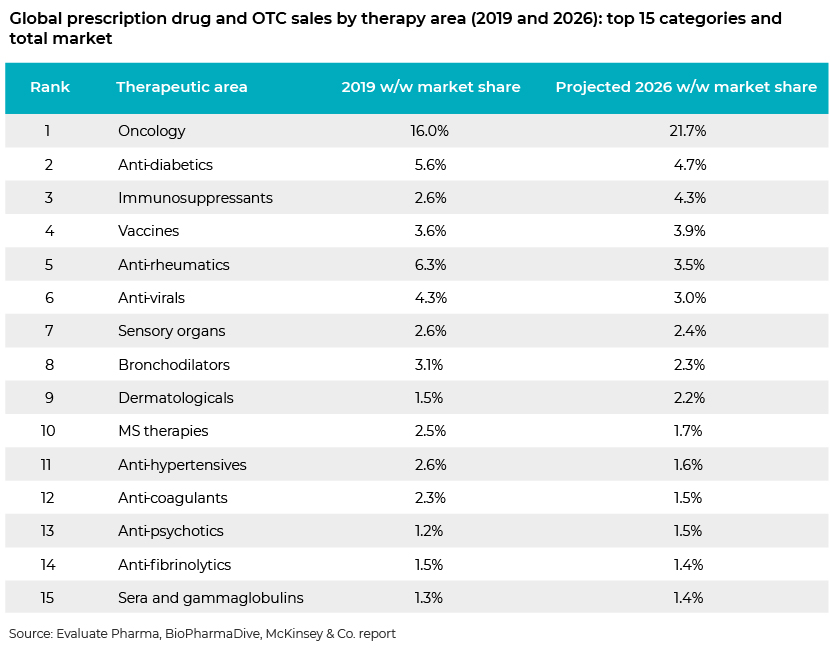

Although 2020 physician-administered product sales of the top 15 companies dropped by USD4.9bn, we believe the market has largely ignored the increasing burden of other diseases and conditions and the work of other pharma companies involved in therapeutic areas related to those. For example, growth in global prescription drug sales over 2020-26 is forecast at a 7.4% CAGR, with oncology therapies accounting for 21.7% of 2026 sales (USD311bn), according to Evaluate Pharma World Preview 2020. The pharma companies now leading the COVID-19 vaccine race may not be seen as winners in the long term based only on COVID-19 research. Roche will be the leading prescription drug company in 2026 with sales of USD61bn, according to the abovementioned report, retaining its top spot from 2019, whereas Roche is nowhere in the COVID-19 vaccine race. Similarly, Bristol Myers Squibb is forecast to be the seventh-largest prescription drug company by revenue in 2026; it has no current focus on COVID-19. Eli Lilly’s anti-diabetic and obesity drug Tirzepatide is currently the most valuable project in the pharma-sector pipeline, with a net present value (NPV) of USD7.8bn. However, COVID-19 candidates do not even feature in its top 10 most valuable R&D projects ranked by NPV.

Regenerative medicine – the next wave

The shortage of organs to replace diseased or destroyed human organs and tissue is the main reason for the emergence of the field of regenerative medicine and tissue engineering; the big pharma companies are increasing research and investment in this field. Regenerative medicine is the branch of medicine that develops methods to regrow, repair or replace damaged or diseased cells, organs or tissue through the generation and use of therapeutic stem cells, tissue engineering and the production of artificial organs to provide an alternative to organ transplantation. The key companies in this field include Japan Tissue Engineering, Vcanbio Cell & Gene Engineering Corp., Takara Bio, Green Cross Cell Corporation, Mesoblast Ltd, Ankia Therapeutics and Avita Medical Ltd, all of which have seen a more than 200% spike in their enterprise values, and some even more than 1,000%, in the past 10 years. This space has also seen a consistent rise in the number of financing rounds since 2013, including IPOs and venture financing. The next wave of regenerative medicine has the potential to address significant healthcare issues including Alzheimer’s disease, AIDS, diabetes, blood cancers, heart disease and blindness. Although the space has suffered slightly since the start of the pandemic, it presents an opportunity for consolidation and fund raising at the current valuations, as the associated companies including the large pharma companies continue to invest in their pipeline of regenerative candidates.

Scope for consolidation

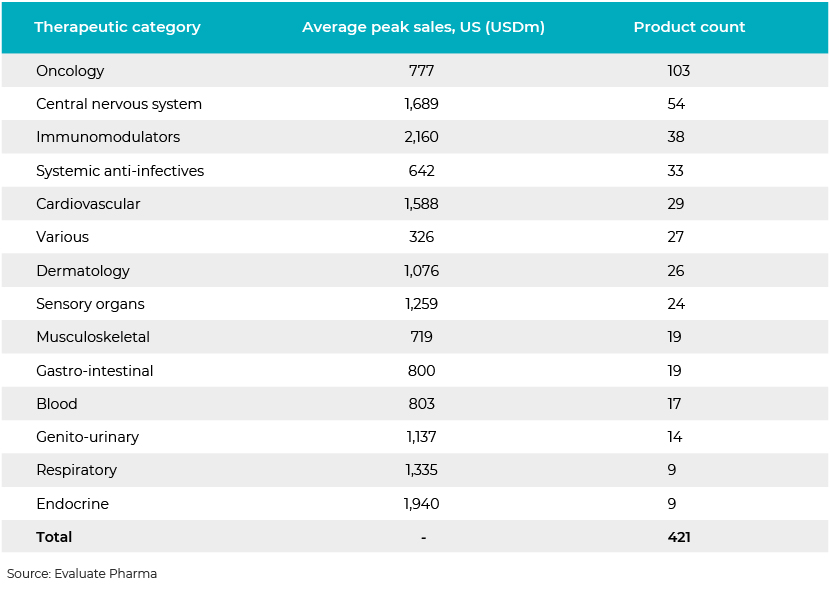

The pharma sector is regularly involved in out-licensing and in-licensing agreements and sale of assets (development candidates). However, it is also active in terms of M&A and fund raising. As product development takes years, we often see heightened M&A activity in the space, with small companies researching novel candidates are acquired by large companies so they can accelerate the development and approval of candidates. Currently, there are 421 phase III assets in the pipeline in the US alone, clearly indicating an increased pipeline of financing activity and M&A activity in the very near future as these candidates move towards the approval, registration and commercialisation processes.

This pipeline represents only US candidates. Europe, the UK, China, Canada, Japan, Germany, France and other countries make up approximately 50% of the global pipeline of development candidates.

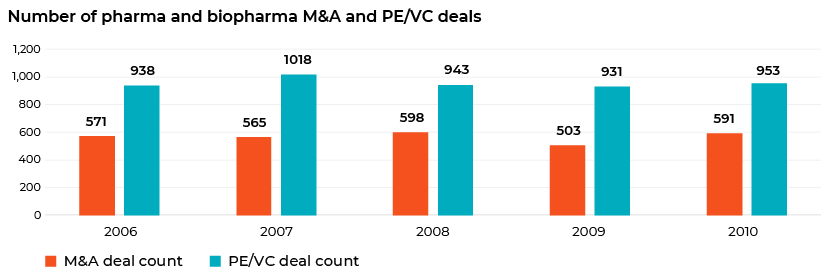

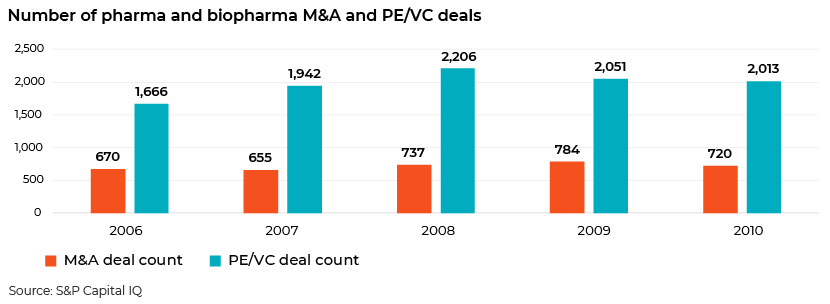

A comparison against 2008 levels shows that global M&A activity and PE/VC deal flow bounced back to pre-crisis levels after 2009.

M&A activity in 2020 was not too bad, though. PE and VC activity was slightly low but not completely muted.

The top 10 biopharma M&A deals announced in 2020 had a combined value of USD97bn. Notable transactions included AstraZeneca’s offer to acquire Alexion for USD39bn, Gilead Sciences’ acquisition of Immunomedics for USD21bn, Bristol Myers Squibb’s acquisition of MyoKardia for USD13.1bn, Johnson & Johnson’s acquisition of Momenta Pharmaceuticals for USD6.5bn and Gilead’s acquisition of Forty Seven for USD4.9bn.

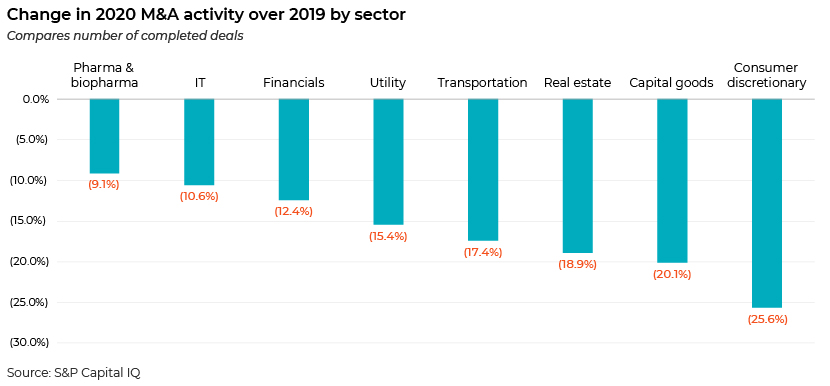

Although M&A activity declined across sectors compared to 2019, pharma and biopharma M&A activity suffered the least.

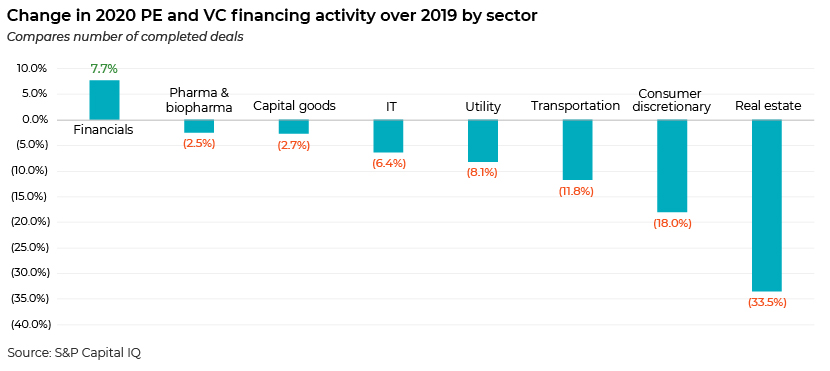

Although PE and VC financing activity declined across sectors, deal activity in pharma and biopharma fared better than that in other verticals except for the financial sector. On the financing front, on the top of the list was Blackstone Group’s capital injection of up to USD2bn into Alnylam Pharmaceuticals, followed by Sana Biotechnology’s USD700m private placement involving ARCH Venture Partners, Flagship Pioneering and Canada Pension Plan Investment Board, and Invitae’s USD475m share placement deal supported by its existing investors such as Farallon Capital Management and Driehaus Capital Management.

The public offering space is also active

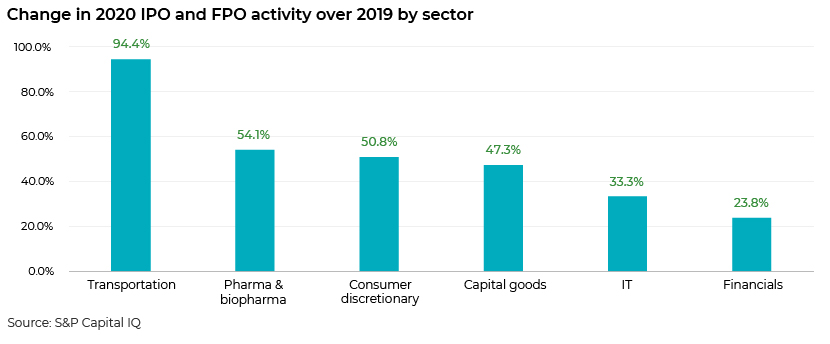

The public equity offering space, including IPOs and FPOs, also showed positive trends for pharma and biopharma in 2020 over 2019 offerings, whereas sectors such as utilities and real estate showed negative trends.

Where pharma companies are with and without the COVID-19 vaccine pipeline

Although the frontrunners in the COVID-19 vaccine space have gained since the start of the pandemic, the gap in meeting the needs of other therapeutic areas continues to widen. Ongoing research by the large pharma and other pharma and biotech and biopharma companies in therapeutic areas and therapeutic modalities including regenerative medicine offers increasing scope for growth for these companies, whether they have active COVID-19 vaccine pipelines or not. COVID-19 vaccine candidates do not even feature in the top 10 most valuable pharma industry R&D projects ranked by NPV. With the vaccines already being rolled out, the sector as a whole has yet to see new highs in consolidation and financing. Several mega-merger and large transactions (USD50bn+), many medium-size transactions (USD25-50bn) and a number of smaller bolt-on transactions (USD5-15bn) are scheduled for 2021, particularly in the oncology and cell and gene therapy space. This year is already off to a good start, as evidenced by the continued M&A and financing activity in 1Q.

Acuity Knowledge Partners (Acuity) assists investment banks in the different stages of investment and with M&A opportunities and financing and public offering advisory. Acuity has a strong team of subject-matter experts supporting a number of bulge-bracket investment banks and boutique investment banking advisory firms across the world. Our Investment Banking team has considerable experience in providing M&A, equity capital market (ECM), debt capital market (DCM) and analytics solutions to our clients.

Sources:

https://www.biopharmadive.com/news/coronavirus-vaccine-pipeline-types/579122/

https://www.mckinsey.com/~/media/McKinsey

https://www.evaluate.com/thought-leadership/pharma/evaluatepharma-world-preview-2020-outlook-2026

https://www.fiercepharma.com/special-report/top-20-pharma-companies-by-2019-revenue

https://www.fiercepharma.com/special-report/top-10-largest-biopharma-m-a-deals-2020

https://www.ipharmacenter.com/post/top-10-pharmaceutical-companies-by-revenues-in-2020

https://www.mckinsey.com/business-functions/risk/our-insights/covid-19-implications-for-business

https://www.nypharmaforum.org/wp-content/uploads/2018/06/NYPF-MASTER-May-2018-deck-v-final-1.pdf

Tags:

What's your view?

About the Author

Arnab Banerjee has ten years of experience in investment banking and equity research. In his current role, he supports a mid-market investment bank based out of the US. Arnab has expertise in areas including M&A, equity capital markets (ECM) and debt capital markets (DCM) and plays an active role in the development and training of team members. Prior to joining Acuity, he worked as Equity Research Analyst at Guggenheim Partners. Arnab holds a Master of Business Administration in Finance from ICFAI Business School, Hyderabad, India.

Like the way we think?

Next time we post something new, we'll send it to your inbox