Published on July 15, 2020 by Khushboo Agarwal

The COVID-19 pandemic is probably one of the most serious threats the world faces. More than 10m have already been infected, more than 100 countries have closed their national borders, and the movement of trade and persons has come to a halt. This has also impacted financial markets and the banking system, which are likely to see an increase in non-performing assets and credit losses. US bank profits fell by 69.6% to USD18.5bn in the first quarter of 2020 compared to last year, according to a Reuters report dated 16 June, due to the economic impact of the novel coronavirus pandemic. This was a result of writing off delinquent debt and provisioning for loan losses.

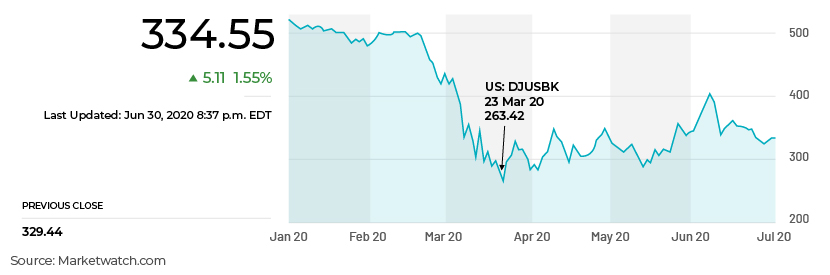

The following graph shows the movement of the US Bank Index, affected by the COVID-19 pandemic:

Major effects on US banking

-

-

Subdued credit growth and interest income

-

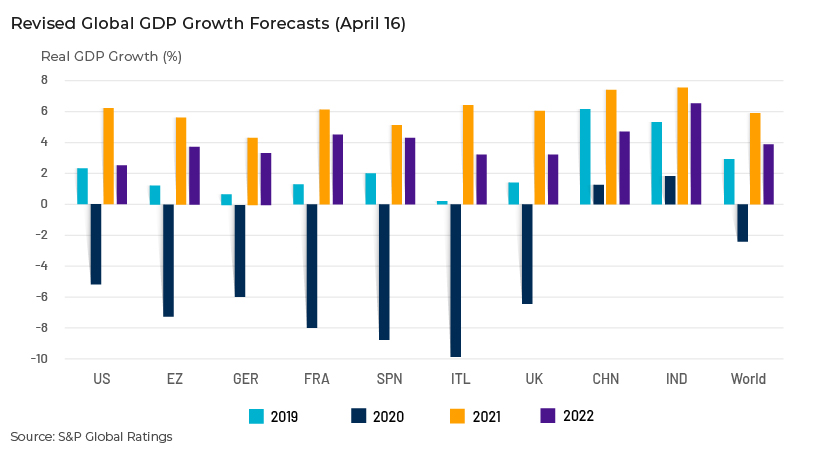

US GDP is forecast to contract 5.2% in 2020, as per S&P Global Research estimates (16 April 2020), to account for a prolonged effect of the pandemic. Global economies have come to a standstill, stock markets have crashed, and manufacturing/production has slowed. This will likely lead to lower credit growth in the commercial, industrial, real estate, auto and credit card lending areas. Apart from this, lower borrowing volumes, together with falling Fed rates, would impact banks’ net interest income.

-

-

-

Decline in fee income

-

Fee income will likely fall, driven by lower consumer spending, decreased assets under management and a slowdown in investment-banking activities such as M&A

-

-

Lower credit quality

-

The credit quality of banks’ loan portfolios is expected to deteriorate in the event of a global recession. The rapid increase in job losses would soon have a material impact on retail credit quality, including mortgages and credit cards. “Banks such as JPMorgan, Capital One and Synchrony Financial have large portfolios of cards tied to retailers, many of which have been forced to shutter stores,” noted a Bloomberg report (25 March 2020). Banks with exposure to severely affected sectors such as retail and travel will likely experience a significant deterioration in their loan portfolios and collateral values

-

Some of the Fed’s initiatives to support the US economy and financial markets

-

Reducing banks’ cost of borrowings

-

The Federal Open Market Committee (FOMC) has cut the target Fed rate, i.e., the rate at which banks borrow from each other overnight. The rate was cut from 1.5% to 1.0% on 3 March 2020 and further reduced to c.0.25% on 15 March 2020. This was mainly to spur business investment and promote borrowings, to ensure uninterrupted flow of credit in the economy

-

Temporarily relaxing regulatory requirements: The Fed is encouraging banks – both the largest banks and community banks – to dip into their regulatory capital and liquidity buffers, so they can increase lending during the downturn

-

-

Supporting financial markets

-

Repurchase agreements – The Fed is using the repo market to funnel cash to money markets. The repo market is where the Fed borrows and lends cash and short-term securities, usually overnight. Before the pandemic hit the market, the Fed was offering USD100bn in overnight repo and USD20bn in two-week repo. It has expanded the programme significantly – both in terms of the amounts offered and the length of loans. As of 9 April, it was offering USD1tn in daily overnight repo, and USD500bn in one-month and USD500bn in three-month repo

-

Quantitative easing (QE) – The Fed aims to increase the flow of money in the economy using QE. On 12 March, it announced buying at least USD500bn in Treasury securities and USD200bn in government-guaranteed mortgage-backed securities over the coming months. However, on 23 March, it made the purchases open-ended, to include even commercial mortgage-backed securities, to support the smooth functioning of the markets

-

-

Supporting businesses and corporations

-

The Commercial Paper Funding Facility (CPFF) – This includes purchase of unsecured and asset-backed CP directly from companies, to make money directly available to corporations. This will also help rebuild investor confidence in term lending in the CP market. The Primary Market Corporate Credit Facility (PMCCF) allows the Fed to lend directly to corporations by buying new bond issuances and providing loans

-

The Paycheck Protection Program (PPP) – The Small Business Administration (SBA), the Main Street New Loan Facility and the Main Street Expanded Loan Facility (MSELF) all aim to provide the necessary funds to smaller entities to meet their basic and fixed costs, with the benefit of repayment deferments and loan forgiveness

-

The way forward

The path to recovery will not be easy. If businesses and corporations do not bounce back after the lockdowns, loan books would be affected. Fed Chair Powell indicated on 15 March that the key interest rate may remain low “until we’re confident that the economy has weathered recent events and is on track to achieve our maximum employment and price stability goals”.

A fear of rising non-performing assets will require banks to set aside reserves and constantly re-evaluate assets and collateral. Lenders would need to actively update the credit outlook for borrowers, ensuring that rating actions follow COVID-19-induced stress testing. On the operations front, banks would need to adapt to a new normal and save their margins through cost-cutting measures such as closure of branches and reduced staffing. They would now have to focus more on a flexible and remote working structure.

Adapting to the new normal

We believe COVID-19 will have a deep impact on how we do business, globally. Banks would need to be flexible enough to adapt to this new normal as they rethink their strategies for 2020. This is where Acuity Knowledge Partners can help you navigate through these challenging times. Our global offices can enable you to handle business demand and uncertainty with ease. We are currently using our understanding of the market to help clients chart their 2020 strategies.

To help our clients navigate through both the people and business impact of COVID-19, we have created a dedicated hub with a variety of topics, including our latest thinking, thought-leadership content and action-oriented guidelines and best practices.

Links to sources

https://www.brookings.edu/research/fed-response-to-covid19/

https://www.spglobal.com/en/research-insights/articles/covid-19-daily-update-april-16-2020

https://www.spglobal.com/en/research-insights/featured/economic-implications-of-coronavirus

https://www.spglobal.com/en/research-insights/featured/economic-implications-of-coronavirus

https://www.euromoney.com/article/b1kxrvx42r38r6/can-banks-withstand-the-impact-of-covid-19

https://www.cnbc.com/2020/04/15/bank-of-america-bac-earnings-q1-2020.html

What's your view?

About the Author

Khushboo Agarwal is part of the Commercial Lending team at Acuity Knowledge Partners, primarily responsible for conducting credit reviews for a leading US bank. She has over 8 years of work experience. Prior to Acuity, she worked with a leading credit rating agency in India and was engaged in credit risk rating of large companies, including financial projections and compiling outlook summaries. She has also worked in a leading international bank, supporting the Credit Analysis and Hedge Fund Portfolio Monitoring segments. Khushboo is a CFA charterholder and holds a Bachelor of Business Administration from St. Xavier’s College, Kolkata.

Like the way we think?

Next time we post something new, we'll send it to your inbox