Published on July 8, 2019 by

The US economy is all set to accelerate from 2019 amid low unemployment, well-contained inflation, a recovery in private investment and an accommodative fiscal stance. Tax cuts and the Jobs Act have also paved the way for growth. The tax cuts and higher defense and non-defense spending are likely to drive consumer demand and lower the unemployment rate to below 3.5% in the long run, as per the IMF’s estimates. On the other hand, reduced taxes and higher spending will likely translate into a wider fiscal deficit (2018: 4.5% of real GDP), leading to an unsustainably high level of public debt (2018: net debt/real GDP of 80.9%).

The US’ fiscal boost, aimed at increasing demand, should translate into higher import growth, weighing on the current account deficit that, as per the IMF’s estimates, will likely rise to 3.5% of real GDP in 2019/20 vs. 2.3% in 2018. Therefore, the US has implemented stringent trade policies in the form of higher import duties, leading to serious concern about global imbalances and a negative spillover effect on emerging economies. The spillover could cause capital flight from some emerging economies in light of increasing global imbalances, dollar strength, and market volatility.

The US imposed tariffs on China – a 25% import duty on USD300bn worth of goods. China retaliated by imposing tariffs on USD60bn worth of goods imported from the US. The tariffs have weighed heavily on China’s manufacturing sector, of which 50% is export-oriented. Additional US tariffs on Chinese goods could be a serious threat to China’s dominance as a global manufacturing hub.

In 2018, China completed four successful decades of its “reform and opening-up” policy, which has transformed its economy into the second largest in the world. The rapid digitization of sectors such as banking and e-commerce, and fintech firms has been the growth engine in China’s new era. China is now implementing more reforms to strengthen its footprint in international trade, including (1) reducing entry barriers in the financial services and auto sectors, (2) reducing import tariffs on consumer goods and in the auto sector, and (3) drafting a friendlier foreign investment policy that reduces sectoral restrictions. However, the growing rift with the US is increasing concern, as retaliating to US tariffs could increase downside risk to China’s trade relations and economic growth.

Banking loan growth in China has been strong on the back of solid economic growth and ultra-loose monetary policy adopted by its central bank, the People’s Bank of China (PBoC). China’s economy saw strong growth of 6.5-10.5% in 2009-18, when the PBoC launched a large stimulus program of RMB1tn. Driven by this solid liquidity cushion, lending by China banks witnessed 15-20% growth in 2009-18. China’s economy is likely to slow and grow at a modest 5.7-6.3% from 2019-22, as per the IMF’s forecasts, owing to challenges arising from the US-China trade war. However, lending by China banks recorded strong growth of 13% y/y in 1Q19, albeit slower than the historical average. The PBoC’s six consecutive reserve requirement ratio (RRR) rate cuts since early 2018 have injected liquidity into the banking system and underpinned lending growth. The PBoC’s RRR cuts indicate efforts to fuel economic growth and support lending to small and medium-size enterprises (SMEs) and privately owned enterprises, the worst hit since the government’s effort to curtail shadow banking.

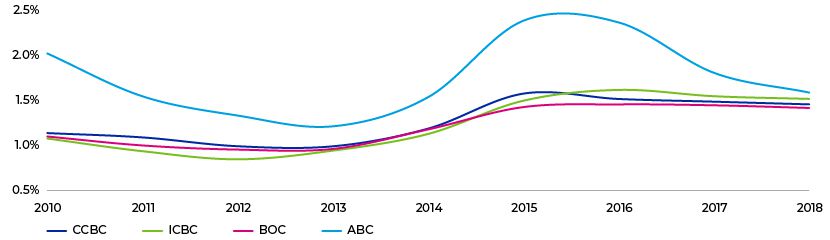

NPLs – Rising since 2013

Source: Annual reports

CCBC – China Construction Bank Corporation, ICBC – Industrial and Commercial Bank of China, BOC – Bank of China, ABC – Agricultural Bank of China

China’s manufacturing sector is highly dependent on exports (50% export-oriented), and a disruption due to the trade war could impact banks’ asset quality. The May 2019 manufacturing PMI reading of 49.4 (cf. 51.9 in May 2018) reflects the slowdown in China’s economic growth amid the escalating trade war with the US. The new export orders reading plunged to 46.5 in May 2019 from 49.2 in April 2019 (cf. 51.2 in May 2018). The trade war has also weighed on business sentiment in the US, with the US manufacturing PMI falling to 50.1 in early June 2019, the lowest reading since 2009. The higher import tariffs have increased raw-material costs for two-thirds of the manufacturers in the US. Although they would pass on incremental costs to final consumers, elevated costs could impact consumer sentiment and dent discretionary spending.

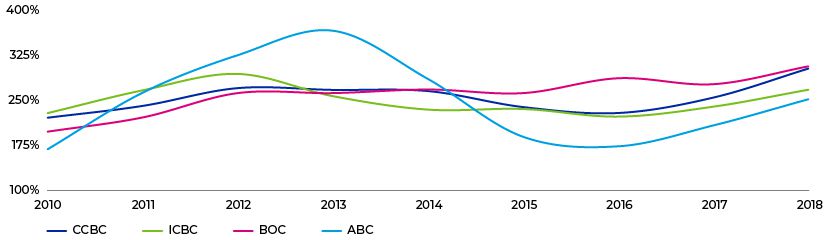

Higher provisioning due to surge in NPLs

Source: Annual reports

China’s PMI has been trending down since the start of the US-China trade war

Source: National Bureau of Statistics of China

As trade-war tensions continue to loom, banks in China are likely to increase loan-loss provisioning to cover the risk of asset quality deterioration. Issuing new loans to SMEs, as per PBoC instructions, will likely be another challenge to banks that would otherwise stick to the conventional underwriting of loans to low-risk state-owned enterprises (SOEs).

At Acuity Knowledge Partners, our Commercial Lending teams provide invaluable offshore support to banks through helping in the prudent underwriting of loans to large corporate, mid-corporate and SME customers. Our credit managers provide granular insight at the macro level and help banks’ credit risk team to identify potential risks in lending. Our delivery center in Beijing has a team of 100+ analysts who understand the local market well and currently support some of the largest global banks.

Sources:

-

https://www.imf.org/en/Publications/SPROLLs/Staff-Discussion-Notes#sort=%40imfdate%20descending

-

https://www.ft.com/content/fa026b16-492f-11e9-bbc9-6917dce3dc62

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox