Published on August 26, 2020 by Gaurav Jain

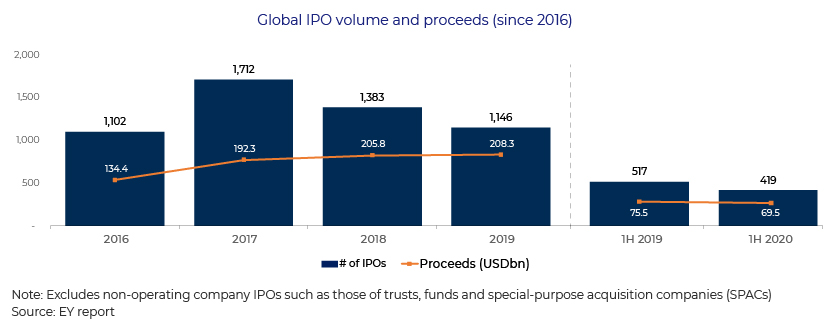

The equity market was impacted significantly by the COVID-19 pandemic in the first half of 2020. Global IPO activity slowed sharply, especially in April-May, with a 48% decrease in volume (97 deals) and a 67% decrease in proceeds (USD13.2bn) compared to April-May 2019. 1H 2020 closed with deal volume of 419 deals and proceeds of USD69.5bn, decreasing 19% and 8%, respectively, from 1H 2019.

Deal volume (81 deals) and proceeds (USD24.5bn) from the Americas fell 30% from 1H 2019, according to an EY report, while EMEIA IPO deal volume (68 deals) and proceeds (USD10.1bn) fell 50% and 44%, respectively. Asia Pacific IPO activity rose 2% in terms of deals (270 deals) and 56% in terms of proceeds (USD34.9bn) compared to the previous year. The Asia market was driven by strong activity in China’s STAR Market (Shanghai Stock Exchange Science and Technology Innovation Board) and the Hong Kong Exchange.

Turnaround in US IPO market since June

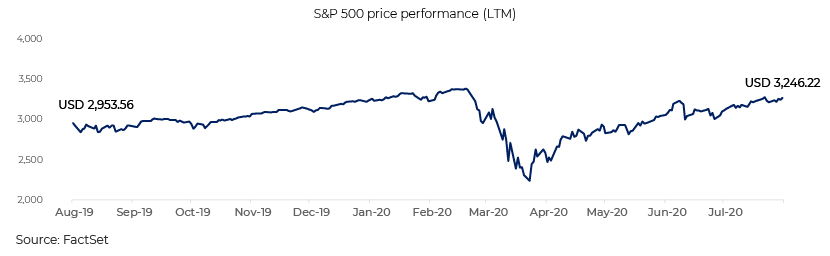

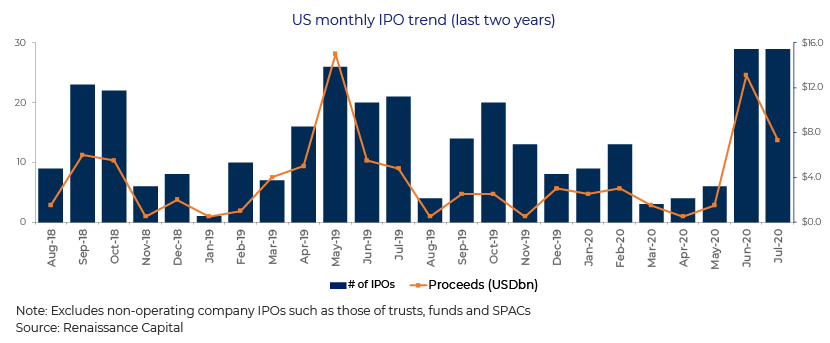

The US stock market was in an 11-year bull run in March due to rising concerns about the pandemic and its impact on business. IPO volume from March to May was the lowest three-month volume in the past four years. However, IPO activity turned around in June and July as equity markets rebounded. June recorded the highest single-month volume of the past decade and July remained strong.

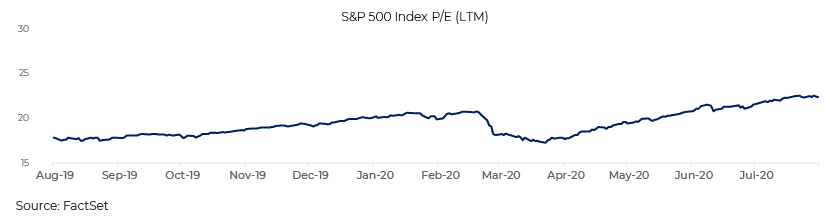

The S&P 500 had increased by 46% since 23 March as of 31 July 2020, and crossed the start-of-year level. The return for the LTM period (since 1 August 2019) was 11%.

With the recovery in markets, valuations are also improving. S&P 500 Index P/E had increased to 22.4x as of 31 July 2020 from 17.3x on 23 March.

A total of 93 companies (excluding SPACs) launched IPOs on all US exchanges, raising USD29.1bn YTD. More than 60% of these IPOs were priced in June and July. In July, 29 IPOs were priced in the US, representing a 38% increase from the 21 priced in July 2019.

Total proceeds amounted to USD7.3bn in July 2020, 52% above the USD4.8bn raised during July 2019, although 44% lower than the USD13.1bn raised in June 2020.

Healthcare and technology sectors driving IPO activity in US

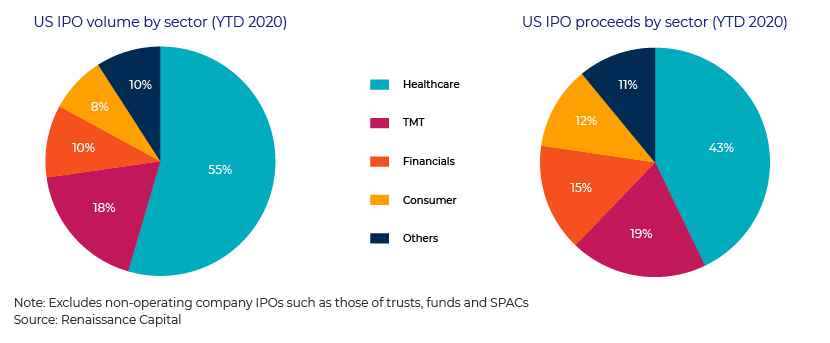

The healthcare and technology sectors reported the highest number of deals until July 2020, representing 55% and 18% by deal volume, respectively. The healthcare sector also dominated in terms of proceeds, contributing 43%, followed by technology with 19%.

SPACs breaking records

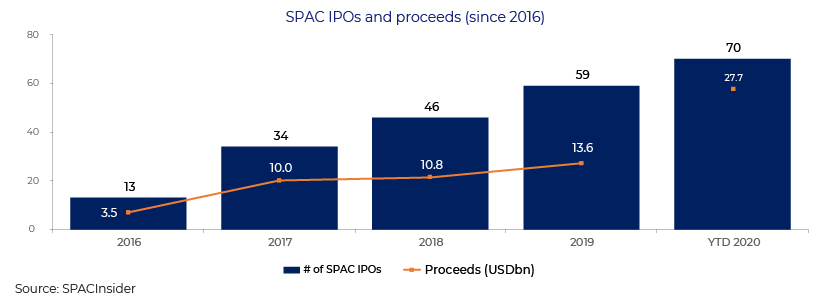

Seventy SPAC IPOs have raised USD27.7bn YTD in the US, compared with 59 IPOs raising USD13.6bn for full-year 2019. The average size of an SPAC IPO so far this year is USD395m, compared with USD231m last year. Bill Ackman and Pershing Square raised USD4.0bn in July, the largest SPAC IPO to date.

Uncertain but positive outlook

A considerable amount of uncertainty remains over the second half of the year due to the possibility of a second wave of infections, the US presidential election in November and low oil prices. However, stock prices and valuations are recovering, improving investor sentiment, and the volatility index (VIX) is back to normal, approaching levels more conducive for companies to go public.

Given the backlog of IPOs in the pipeline, the outlook for the second half of 2020 seems good. The total IPO backlog, including SPACs, is 92 on all US exchanges. The healthcare sector will likely remain active and dominate 2H 2020. More than 50% of the current backlog comprises healthcare IPOs, as per the NYSE website.

Paul Go, EY Global IPO Leader, says that “Although IPO activity declined in April and May 2020 because of the economy lockdown in most markets, we began to see a strong rebound in June. Well-prepared companies, in the right sectors and business models, can successfully adjust during the pandemic, and will find the right window of opportunity amid turbulent capital markets for the rest of 2020.”

Alan Jones, IPO Services Leader, PwC US, says, “The US IPO market continues to benefit from the broader market rebound in Q2 that has priced in a "V" shaped economic recovery. The re-opening of the IPO window unleashed a torrent of biotech and technology IPOs, as well as SPACs.”

Greg Chamberlain, VP ECM, JPMorgan Chase, says, “The recent IPOs reinforce the idea that equity investors are embracing high-quality growth companies right now. If companies are ready, there is a good window available.”

How Acuity Knowledge Partners can help

We have experience in supporting investment banks in the US, Europe and Asia Pacific. We offer M&A, capital market, restructuring and sustainable finance solutions to our clients. We have a pool of experts providing end-to-end support to ECM advisors, helping the onshore team on live transactions and regular work streams related to IPOs, FOs, RDOs, PIPE, rights, convertible and other equity offerings.

Sources

https://insight.factset.com/u.s.-ipo-market-ipos-rebound-late-in-q2-with-the-equity-market

https://www.pwc.com/gx/en/audit-services/ipo-centre/assets/pwc-global-ipo-watch-q2-2020.pdf

https://www.marketwatch.com/tools/ipo-calendar

https://www.nyse.com/ipo-center/backlog

https://spacinsider.com/stats/

https://www.ft.com/content/77278693-b787-4bb3-aac2-8fee67878e8f

https://www.integrity-research.com/us-ipo-activity-remains-strong-in-july-2020/

Tags:

What's your view?

About the Author

Gaurav has been with the firm since February 2006. He is involved in transitioning and onboarding new client teams for regional and boutique advisory firms focused on Technology, Media and Telecom and Healthcare sectors.

His responsibilities include managing some Investment Banking and Advisory engagements and relationships, coordinating with the stakeholders on new initiatives and services, soliciting feedback, working with teams to identify and improve efficiencies and productivity, mentoring team members on complex and value-added analysis, and implementing industry best practices to enhance client service.

Like the way we think?

Next time we post something new, we'll send it to your inbox